Nearly 9/10 executives consider investing in AI and data to be a top priority for their company. But 8/10 of those initiatives are likely to end in failure. In this post, we explore the key reasons behind...

Large Language Models and generative AI tools have transformed the way organisations bring order to the vast amount of online and offline data available. AI can narrow down this data universe to a concise...

Artificial intelligence (AI) offers an incredible amount of opportunity from enhancing productivity to managing information. But, because AI "learns" from the data you give it, it's critical to develop...

In consulting, every opportunity starts with a market trigger, whether it be a change in leadership, a new industry regulation or an unexpected shift in investor sentiment. These trigger events can open...

See how Nexis+ AI and Nexis ® Data+ help management consultants power faster research, credible insights, and compliant AI innovation. As a management consultant, data is your competitive edge. Whether...

Could 2023 be the year the world rebounds from the 2020 pandemic? The answer is “yes”, according to Deloitte, which predicts that “2023 could be the year the ‘new normal’ fully comes into view. There will be opportunities to help define the future, one in which profits and purpose are inextricably linked. Finding and making the most of opportunities that emerge, however, will require data-driven insights. That’s where third-party data APIs come in. Armed with analytics platforms and the data to power them, Financial Services organizations can uncover timely, relevant information that enables strategic decisions to maintain or gain a competitive advantage.

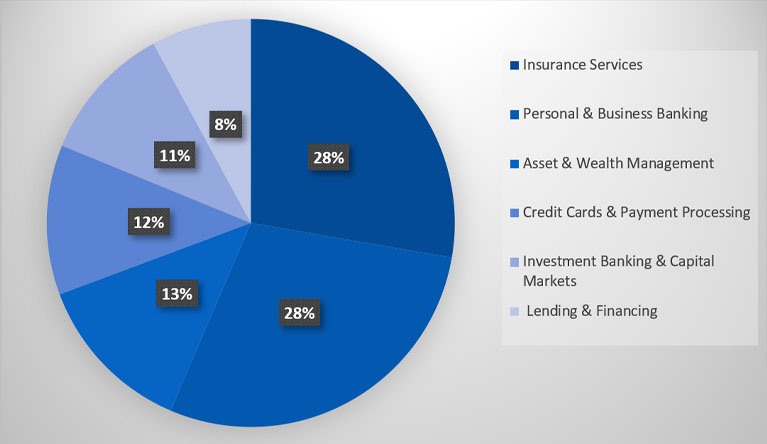

Where is big data being used across the financial sector?

Source: World Bank Group Research & Policy Brief

So how do third-party data APIs help?

Third-party data complements internal data

Financial services organizations already collect a considerable amount of first-party data related to customer interactions and financial transactions. But internal data alone only tells part of a story. You could, for example, see a usage spike, but what’s causing it? Third-party data can help fill in that blank and others.

Now, on to the types of data that can help you strengthen your competitive standing.

News and social commentary

In order to support digital transformation and deliver on consumer expectations for seamless, personalized customer experiences, financial services organizations need to better understand what makes customers tick. In fact, The Financial Brand notes that 66% of customers expect organizations to understand their unique needs and 52% expect personalized offers with every interaction. That’s a tall order.

With access to a wider range of data than you would otherwise have, you gain important context to explain customer behaviors. For example, analyzing news and social commentary offers insights into emerging trends and consumer expectations. You can also leverage transcripts of interviews with industry playmakers and thought leaders. Analyzing statements in combination with news coverage can provide competitive intelligence you need to inform decisions.

By accessing news and social commentary data, financial services organizations can proactively develop products or services to improve customer retention and give you a competitive edge.

ESG news and ratings

Environmental, social and governance (ESG) factors have become increasingly important in recent years. According to one study, 89% of investors considered ESG issues as part of their strategy in 2022, a 5% increase over 2021 results. Salvatore Bruno, chief investment officer at IndexIQ notes, “ESG investing went from being a satellite or a fringe type of an investment strategy to much more of a core-type strategy.”

With demand for ESG-friendly investment portfolios gaining more traction, you can integrate ESG news and ratings into advanced analytics platforms to keep informed, identify investment opportunities, and more. For example, you can filter for adverse ESG news mentions that could signal a reputational or regulatory risk within your portfolio. Similarly, you can use ESG ratings data to analyze prospective additions to your portfolio.

Company Data

Corporate financials and other company-related data APIs offer incredible value as well. As investment firms look for new opportunities, leveraging company data in advanced analytics—such as historical financial performance—can help you predict future performance. This enables you to make informed buy-sell decisions that keep you ahead of the competition.

So, whether you want to garner insights into customer behaviors and needs, inspire innovative new products and services, expand existing markets or enter new ones, leveraging third-party data can help you achieve valuable insights to inform your strategies and gain a competitive advantage in today’s dynamic marketplace.

Choose a one-stop shop for your third-party data needs. See what Nexis® Data as a Service has to offer.