![item image]()

24 May 2018

Author : InfoPro Community Manager

$core_v2_ui.GetViewHtml($post.File.FileUrl, "%{ AdjustToContainer = 'true' }")

Guidance for securities lawyers in an uncertain regulatory environment

Whether you work in a law firm or corporate legal department, helping attorneys gain thorough, timely insight on initiatives percolating through the Securities and Exchange Commission (SEC) is vital—and it can be challenging, even for the savviest information professional.

While the SEC’s regulatory priorities have crystallized in many respects during the first year of the Trump Administration, the outlook on numerous high-impact issues is still cloudy, and the current direction could change. Securities attorneys do not have the luxury of waiting for definitive regulatory action; they must help public companies implement risk and compliance programs that address current requirements and also prepare for potentially major change.

Here are some critical themes for securities regulation in 2018 and tips for tracking them.

Key securities regulatory themes for 2018

Shortly after the confirmation of former Sullivan & Cromwell partner Jay Clayton as SEC chairman in May 2017, he made this statement: “I want to make one thing very clear: There’s not some dramatic shift in priorities at the SEC.” While wholesale change in the agency’s direction has not occurred since that time, Clayton has enumerated several key macro priorities giving structure to the agency’s regulatory approach. Securities professionals should expect to hear more about those priorities as that agenda proceeds.

Promoting capital formation: Clayton has argued on numerous occasions for an approach that actively promotes capital formation—for instance, citing weakness in the initial public offerings (IPO) market over recent years as an indication of the need to streamline rules affecting small and midsize emerging companies considering a public offering. The SEC has already seen success in this area, as IPOs are reaching market 43% more quickly following the agency’s efforts to make the process less onerous.

Protecting retail investors: Clayton has stated concern for reforming rules intended to protect retail investors—or “Mr. and Mrs. 401(k),” as he has colloquially dubbed them. Here, the agency is specifically seeking opportunities to crack down on fraud and eliminate harm to investors caused by a misalignment between their financial interests and those of brokers who may be incented to sell higher-priced investments. A step toward clarifying the fiduciary duty owed by brokers to retail investors occurred April 18, 2018, when the SEC released a proposed new “Regulation Best Interest,” which would mandate a higher bar of conduct for brokers when recommending investments to mom-and-pop investors. The proposed regulation is expected to generate a flood of debate from interested parties during the 90-day comment period.

Cybersecurity and data privacy: On this topic of nearly ubiquitous public concern, Clayton has stated that “really good lawyering and governance is necessary” for public companies to not only protect themselves from harm but also to ensure that they’re appropriately informing investors of risks and potential breaches. The SEC listed cybersecurity among its Office of Compliance Inspections and Examinations (OCIE) 2018 Examination Priorities, and issued a Commission Statement and Guidance on Public Company Cybersecurity Disclosures to assist filers in their compliance efforts.

Below are a few methods for staying current on the SEC rulemaking and enforcement themes described above as 2018 progresses.

Staying current with legal news

Lexis Advance® offers a unique collection of legal industry current awareness resources including must-read content from Law360®; ALM® publications such as The American Lawyer®, The National Law Journal®, and New York Law Journal®; LexisNexis® A.S. Pratt® titles like Pratt’s™ Privacy and Cybersecurity Law Report; and much more.

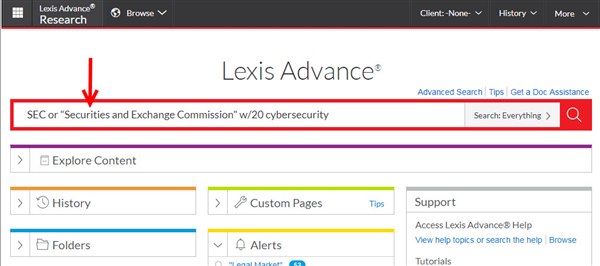

To find analysis on breaking SEC cybersecurity program developments:

- Go to the Red Search Box on the Lexis Advance home screen and enter SEC or “Securities and Exchange Commission” w/20 cybersecurity.

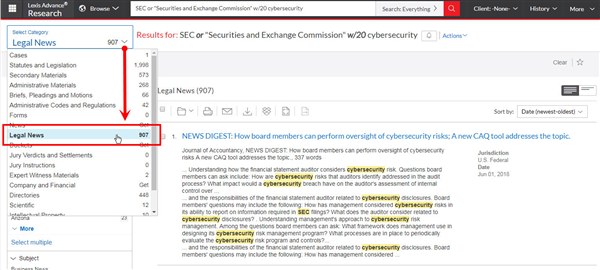

- Click the Legal News category.

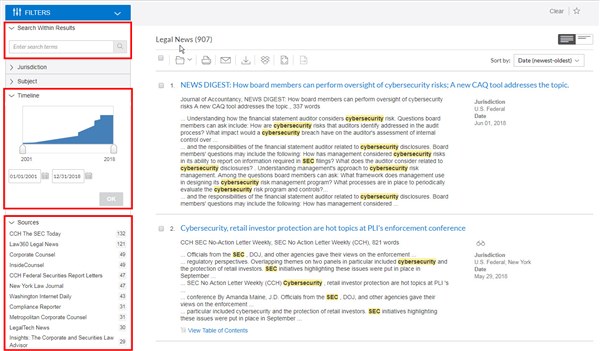

- If desired, narrow your results further to a specific date range or publication using the Timeline or Sources filter—or perform a full-text Search Within Results.

Tracking public comments on “Regulation Best Interest”

Lexis Advance offers a premium collection of SEC materials, searchable in bulk or by specific content type. To see public comments regarding Regulation Best Interest:

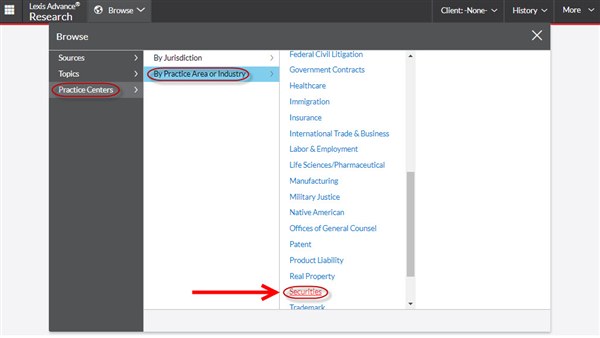

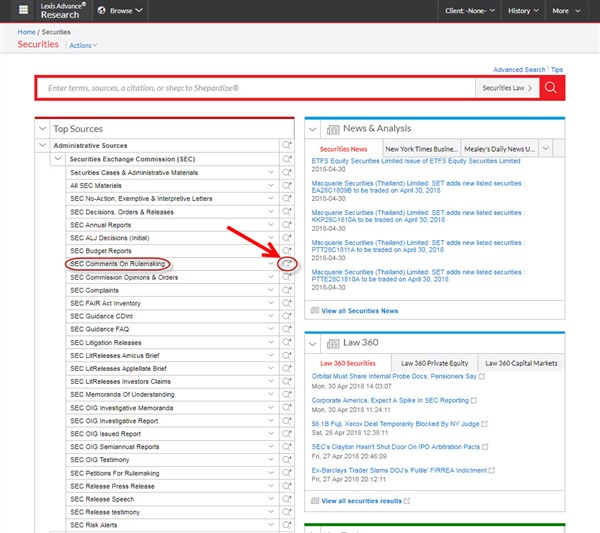

- Go to the Securities Practice Center from the Lexis Advance home screen by clicking the Browse pull-down menu and then selecting Practice Centers > By Practice Area or Industry > Securities.

- Under Administrative Sources, click the magnifier icon next to SEC Comments On Rulemaking to add that database to your search.

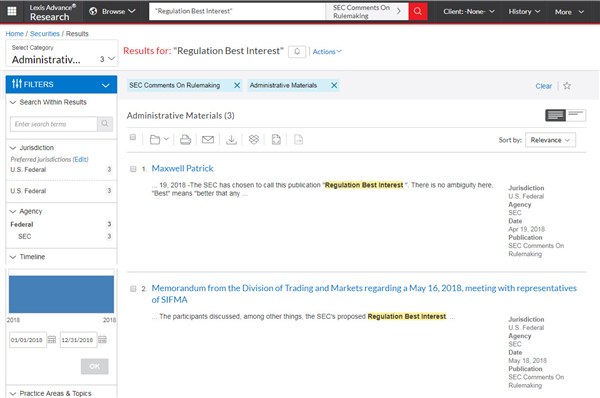

- Search “Regulation Best Interest” to locate all public comments that have been submitted to the SEC during the 90-day comment period for this proposed rule.

- Click individual results to see comments submitted by members of the public.

More details

For more information and research assistance, please contact your LexisNexis account representative.

LexisNexis, Lexis Advance and the Knowledge Burst logo are registered trademarks of RELX Inc. A.S. Pratt is a registered trademark and Pratt’s is a trademark of Matthew Bender & Company, Inc. Law360 is a registered trademark of Portfolio Media, Inc. The American Lawyer, The National Law Journal, New York Law Journal and ALM are registered trademarks of ALM Media Properties, LLC. Other products or services may be trademarks or registered trademarks of their respective companies.