![item image]()

7 Jul 2020

Author : InfoPro Community Manager

$core_v2_ui.GetViewHtml($post.File.FileUrl, "%{ AdjustToContainer = 'true' }")

COVID-19 and securities disclosures

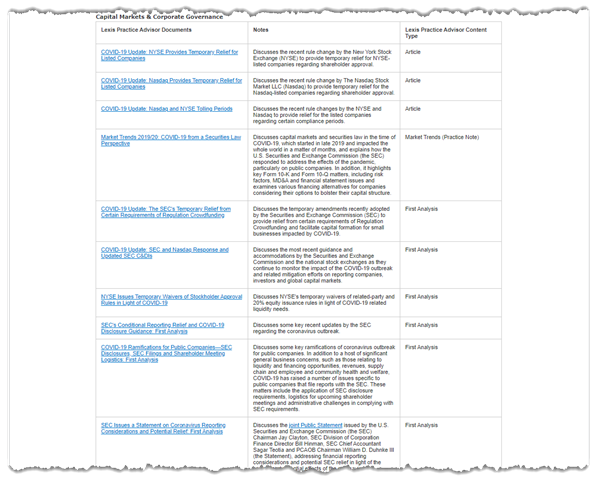

The global COVID-19 pandemic has affected virtually every corner of the economy and forced public and private companies to take a very deep look at all aspects of their businesses—from operations and workplace issues to supply chain and sales challenges. In the public company context, there is an additional layer for business leaders and their counsel to consider: SEC filing obligations and investor communications.

Compliance in the application of existing SEC regulations to the current environment, as well as COVID-19-specific guidance, requires securities practitioners to make use of a broad range of practical guidance, current awareness, secondary analytical content and market research tools.

Authoritative practical guidance: Lexis Practice Advisor® Capital Markets & Corporate Governance

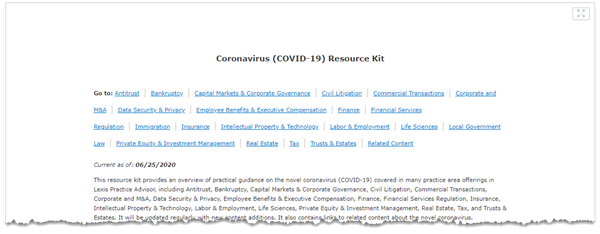

The Lexis Practice Advisor service provides extensive content to help practitioners navigate the SEC reporting regime—including how existing requirements should be applied to encompass the variety of issues facing public filers during COVID-19, as well as commentary on specific pandemic-related releases. Examples from the Lexis Practice Advisor Capital Markets & Corporate Governance practice area include:

Market Trends 2019/20: COVID-19 From a Securities Law Perspective

COVID-19 Update: NYSE Provides Temporary Relief for Listed Companies

COVID-19 Update: SEC and Nasdaq Response and Updated SEC C&DIs

Periodic and Current Reporting Resource Kit

For more content, please visit the Lexis Practice Advisor Coronavirus (COVID-19) Resource Kit, available to all at no charge as part of the LexisNexis® commitment to serve the legal community during this crisis.

Deep analytical coverage of securities compliance topics

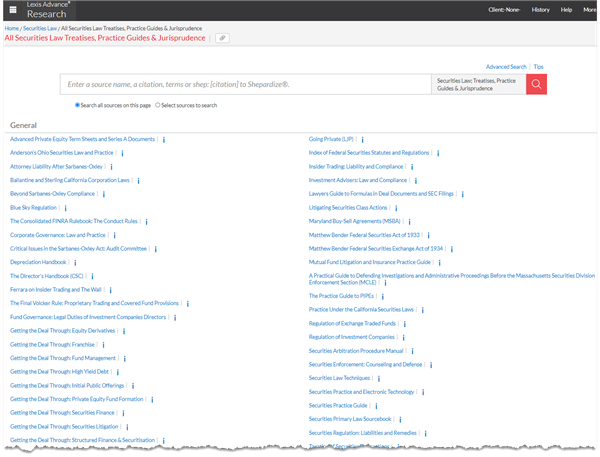

Bundled within the Lexis Advance® service is a comprehensive collection of secondary analytical titles and practice guides to help with the nuances of periodic and current reporting and other critical areas of the securities practice. Top content includes Matthew Bender® titles such as Securities Law Techniques, Securities Practice Guide, Federal Securities Act of 1933 and Federal Securities Act of 1934, plus niche titles like Ferrara on Insider Trading and The Wall from Law Journal Press® (shaping up to be a key topic for pandemic-related securities enforcement).

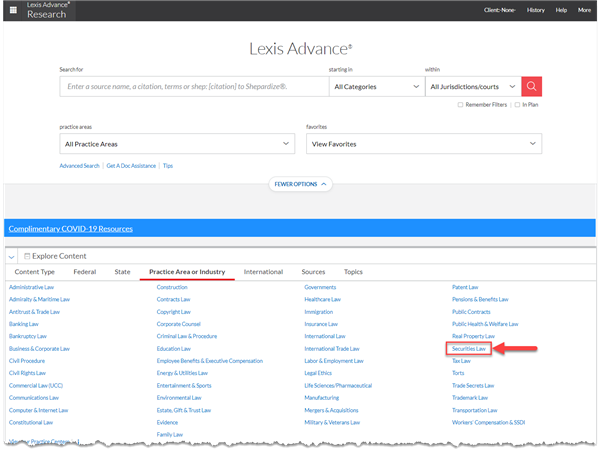

To locate on-point securities analytical sources, simply use the Explore Content portion of the Lexis Advance home page to navigate to the landing page for Securities Law.

Then, choose All Securities Law Treatises, Practice Guides & Jurisprudence to review a full list of relevant titles.

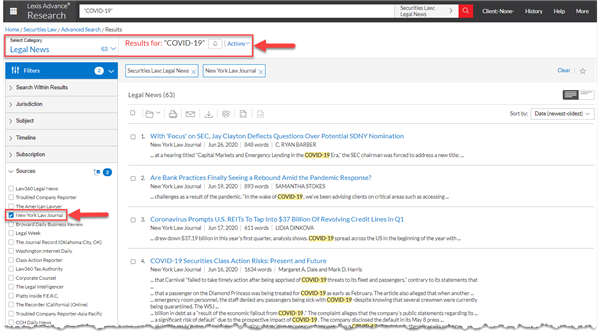

Industry-standard current awareness titles covering COVID-19-related impacts on securities law

The Lexis Advance service offers a unique aggregation of current awareness resources, including must-reads for securities practitioners like Law360®, The Wall Street Journal®, New York Law Journal® (as well as Corporate Counsel®, Delaware Business Court Insider and similar ALM® publications), and 26,000+ other news and legal news publications.

To review COVID-19-related legal or general news sources, use Explore Content to view a collection of securities titles. Then click All Securities Law News or All Securities Law Legal News to search for COVID-19 across the relevant content collections. Expand the Sources filter to narrow to articles from a specific publication.

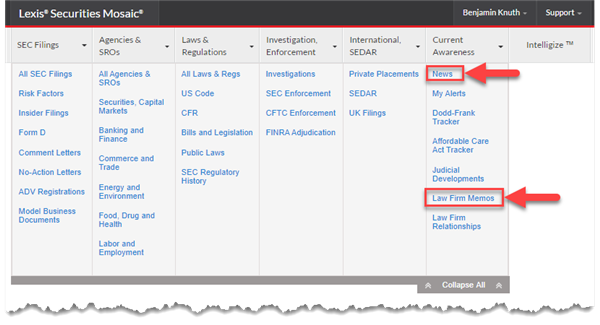

Another unique option for securities-specific current awareness is the Lexis® Securities Mosaic® platform, which offers a heavily read collection of daily securities newsletters, as well as a unique tool, customizable by area of practice and keyword, for searching a collection of 115,000+ Law Firm Memos from top firms across the country.

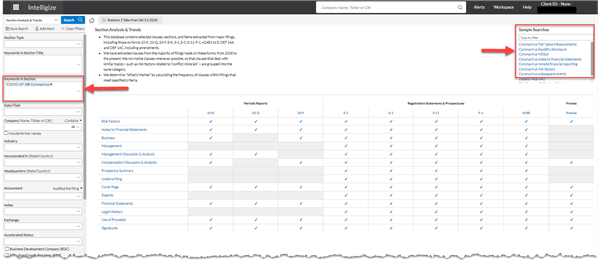

Industry-leading analytics for deep SEC filings research

Top securities attorneys turn to the industry-leading Intelligize® securities analytics tool from LexisNexis to assess current market trends regarding key disclosure points in the COVID-19 environment. With Intelligize, practitioners can quickly dissect SEC filings for key market participants or a target industry and identify how a client’s competitors are handling their disclosures during this unique period.

Example: Using the Section Analysis & Trends application, practitioners can easily assemble a comprehensive list of risk factors disclosed in a specific form type, by a company or range of companies, and containing the term COVID-19 or Coronavirus. Alternately, individuals can choose from a host of prepackaged searches for pandemic-related topics organized to make the process even easier.

For more information on how the LexisNexis portfolio can support the specific needs of your organization’s securities practitioners, please contact your LexisNexis account representative.

LexisNexis, Lexis, Lexis Advance, Lexis Practice Advisor, Securities Mosaic, Intelligize and the Knowledge Burst logo are registered trademarks of RELX Inc. Matthew Bender is a registered trademark of Matthew Bender & Company, Inc. Law360 is a registered trademark of Portfolio Media, Inc. ALM, Law Journal Press, New York Law Journal and Corporate Counsel are registered trademarks of ALM Media Properties, LLC. The Wall Street Journal is a registered trademark of Dow Jones & Company, Inc. Other products or services may be trademarks or registered trademarks of their respective companies.