![item image]()

2 Dec 2018

Author : InfoPro Community Manager

$core_v2_ui.GetViewHtml($post.File.FileUrl, "%{ AdjustToContainer = 'true' }")

New timesaving financial services regulation tools to stay on top of key developments and drill down quickly on complex issues

The financial services industry is rapidly evolving amid a changing regulatory and enforcement landscape. Attorneys can advise their financial services clients efficiently by making the most of practice notes, forms, checklists and other helpful guidance. The newly released Lexis Practice Advisor® Financial Services Regulation offering provides real-world practical guidance and tools for all aspects of regulation and enforcement—ranging from blockchain and other financial technology to bank operations and consumer financial services—and includes guidance authored by leading practitioners that you can’t find anywhere else.

Expansive, practical content

Many financial services attorneys are already benefiting from the more than 100 LexisNexis® A.S. Pratt® and LexisNexis® Sheshunoff® titles available on the Lexis Advance® Banking and Financial Services Practice Center, including key titles on topics ranging from the Bank Secrecy Act to Payment Systems to Consumer Lending and Mortgages. The Lexis Practice Advisor Financial Services Regulation offering now provides an excellent supplement to that exclusive secondary content, including:

• Over 100 Practice Notes offering practical guidance and best practices on a wide range of issues, including Financial Technology, Consumer Banking, Bank Operations, and OFAC, FinCen and Anti-Money Laundering

• Links to hundreds of primary and secondary materials directly within practice notes, forms and checklists, enabling attorneys to conveniently dive deeper into the topic at hand

• Task-based practical guidance that tracks a financial services attorney’s workflow, including practice notes and checklists, along with in-depth current awareness content analyzing rapidly evolving regulatory and enforcement issues

Unique, substantive Practice Notes

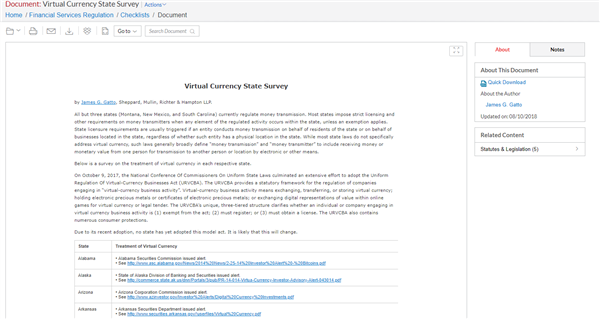

An example of the timesaving, substantive Practice Note content available only on Lexis Practice Advisor Financial Services Regulation is a broad range of content addressing cryptocurrency, financial technology and blockchain technology, including titles such as:

• OFAC Sanctions Regime Extended to Virtual Currencies: Featured Client Alerts, discussing the first significant move by the U.S. Treasury’s Office of Foreign Assets Control (OFAC) to extend application of its anti-terrorism and sanctions regime to virtual currencies

• Understanding Bitcoin and Virtual Currency, providing a full primer and overview of bitcoin and virtual currencies

• Bank Partnerships with Fintech Companies, addressing how cryptocurrency businesses are looking to forge different relationships with established banks for strategic business reasons, and banks are likewise taking interest in providing custody services in connection with cryptocurrency

Extensive Checklists, Charts and Surveys to help ensure nothing is missed

Lexis Practice Advisor Financial Services Regulation includes more than 25 Checklists, Charts and Surveys (and growing) on granular topics to help ensure attorneys consider all issues and cover all bases in advising their clients. For example, it includes checklists on Data Breach Avoidance and Response, a chart on Rulemakings for Enhanced Prudential Standards Pursuant to Dodd-Frank and a State Survey on Legislation of Virtual Currency.

More details

For more information, please contact your LexisNexis® account representative.

LexisNexis, Lexis Advance and Lexis Practice Advisor are registered trademarks of RELX Inc. A.S. Pratt and Sheshunoff are registered trademarks of Matthew Bender & Company, Inc. Other products or services may be trademarks or registered trademarks of their respective companies.