![item image]()

30 Jul 2018

Author : InfoPro Community Manager

$core_v2_ui.GetViewHtml($post.File.FileUrl, "%{ AdjustToContainer = 'true' }")

Providing attorney resources with retail bankruptcies at an all-time high

Although the “retail apocalypse” headlines might be overstating it, statistics demonstrate that 2018 has seen a steady stream of large retailers filing Chapter 11 bankruptcies, and 2017 saw an all-time high in bankruptcy filings. There are many reasons for the uptick in retail bankruptcies. Some retailers are overleveraged entities struggling to modernize in the face of decreasing revenue. Others are simply obsolete, have too many locations or have not adapted to the online shift in American consumer spending habits.

Retailers face unique obstacles in attempting to reorganize under Chapter 11, both practically and legally. Below you will find:

- A brief primer on those obstacles

- Suggestions for staying current on retail bankruptcies and analyzing legal issues unique to retail using the Lexis Advance® service

Retail bankruptcies trends and legal obstacles in restructuring retailers

Retail debt defaults are at an all-time high, and 2018 has already seen 11 major retailer bankruptcy filings. Many of those retailers simply failed to adapt to the changing spending habits of Americans, and that, combined with an excessive number of physical locations, has led to liquidity issues and a need to reorganize. Others say that private equity-led leveraged buyouts have directly led to the demise of some retailers, such as Toys R Us, but still others believe the blame on private equity is misplaced.

Once a retailer files for Chapter 11 protection, however, the business faces unique challenges because of the structure of the Bankruptcy Code. For example, before the 2005 amendments to the Code, retailers could get many extensions of the time frame to assume or reject leases, and thus could go through multiple holiday seasons before deciding which locations to close. Now, pursuant to the amended Section 365(d)(4), retailers only have a maximum of 210 days to determine which leases to reject (and in turn, which locations to close). This very short time frame makes it difficult for debtors to reorganize effectively. In addition, because it can often take longer than 210 days to conduct a liquidation of inventory, this compressed time frame makes it less likely for stakeholders to be willing to work with the debtor and wait for a restructuring to run its course. Some retailers, such as Toys R Us, have come up with novel solutions to this problem by obtaining landlord consent. While Toys R Us was not ultimately successful in reorganizing, that approach may be a model for future retailer bankruptcies.

In addition, the 2005 amendments to the Code changed 503(b)(9) to provide that merchandise received within the 20 days prior to the bankruptcy filing must be paid in cash in full prior to exit from bankruptcy. This change increases the liquidity a debtor needs to emerge from bankruptcy.

Adding to this strain is recent case law, such as In re World Imps., Ltd., 862 F.3d 338 (3d Cir. 2017), which holds that to qualify for an administrative expense claim under Section 503(b)(9), “goods received” refers to physical possession by the debtor or its agent within 20 days of a bankruptcy filing. That means that goods that are shipped, but may take a long time to be received by a debtor, are more likely to fit within the 20-day period and be entitled to administrative priority, adding an additional burden for debtors seeking to emerge from bankruptcy.

Staying current with legal news and journals

Lexis Advance offers a unique collection of legal industry current awareness resources including must-read content from Law360® news; ALM® publications such as The American Lawyer®, The National Law Journal® and New York Law Journal®; The Troubled Company Reporter; American Banker; American Bankruptcy Institute Journal; and many more.

Here are simple steps for finding analysis and updates on retail bankruptcies.

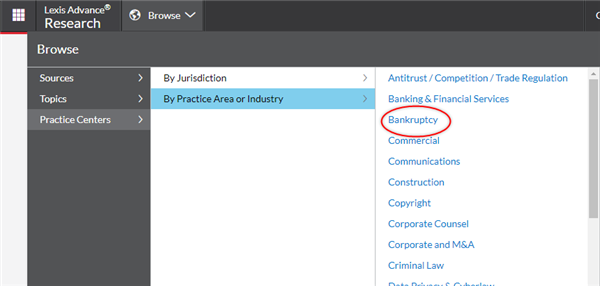

- Navigate to the Bankruptcy Practice Center: From the Lexis Advance home screen, go to the Browse pull-down menu and select Practice Centers > By Practice Area or Industry > Bankruptcy.

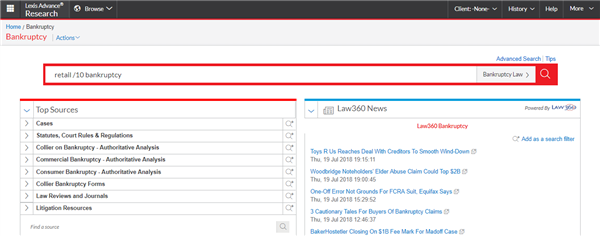

- To search across all sources, in the Red Search Box on the Bankruptcy Practice Center, search retail /10 bankruptcy.

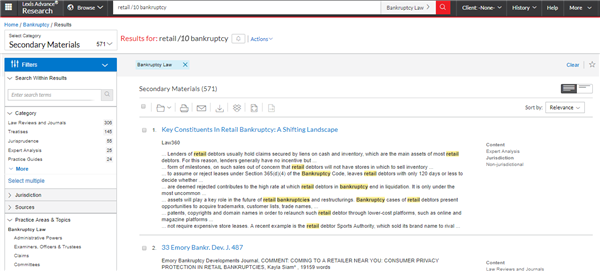

- Filter for secondary sources on the left-hand side.

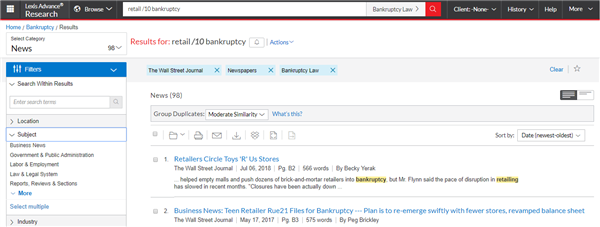

- To review news results, select the pull-down menu on the left and select News. You can then filter for publication type and specific publication.

Analyzing legal issues in retail bankruptcies

LexisNexis is the exclusive provider of the preeminent treatise on bankruptcy, Collier on Bankruptcy®, along with accompanying titles across all aspects of bankruptcy, including real estate, official committees, retention of professionals and lending.

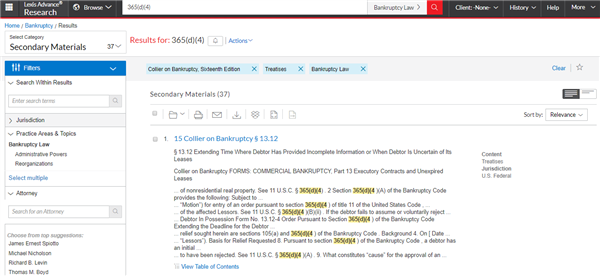

To view secondary sources, such as Collier on Bankruptcy on Section 365(d)(4), search for “365(d)(4)” on the Bankruptcy Practice Center, filter for Secondary Materials, and select Treatises. You can then select Collier on Bankruptcy as a source.

More details

Please consider sharing this information with others on your team. For more details and research assistance, please contact your LexisNexis account representative.

LexisNexis, Lexis Advance and the Knowledge Burst logo are registered trademarks of RELX Inc. Law360 is a registered trademark of Portfolio Media, Inc. Collier on Bankruptcy is a registered trademark of Matthew Bender & Company, Inc. ALM, The American Lawyer, The National Law Journal and New York Law Journal are registered trademarks of ALM Media Properties, LLC. Other products or services may be trademarks or registered trademarks of their respective companies.