![item image]()

13 Sep 2019

Author : InfoPro Community Manager

$core_v2_ui.GetViewHtml($post.File.FileUrl, "%{ AdjustToContainer = 'true' }")

Staying current with Opportunity Zone investment provisions in the Tax Cuts and Jobs Act

The Tax Cuts and Jobs Act (TCJA), enacted on December 22, 2017, delivered truly sweeping changes to tax law. One set of TCJA provisions that will be on many practitioners’ minds for the remainder of this year pertains to Opportunity Zone investments.

The TCJA created significant new tax incentives to encourage investment in eligible properties in certain low-income communities, or Opportunity Zones. Taxpayers with capital gains earned from previous investments that are appropriately reinvested under the Opportunity Zone regime, as defined by the TCJA and subsequent guidance, can temporarily defer tax on those gains, and also reduce the amount of that tax. Further, the biggest jackpot for many clients from the provisions is that future appreciation on the new qualifying investment can potentially escape capital gains taxation entirely, if applicable requirements are met and the investment is held for at least 10 years.

Clients still waiting in the wings to invest must act quickly to meet a key deadline on December 31, 2019 that will determine whether they can take fullest advantage of all aspects of this valuable suite of tax benefits. Meanwhile, at the time of this writing, Treasury has still not yet finalized the relevant regulations. Attorneys await the final guidance, expected imminently, while wrestling with key issues under the two sets of proposed regulations issued to date. Current awareness materials available on the Lexis Advance® service will assist practitioners counseling clients on making the most of these significant tax incentives.

Stay current with focused insight and comprehensive news of tax developments

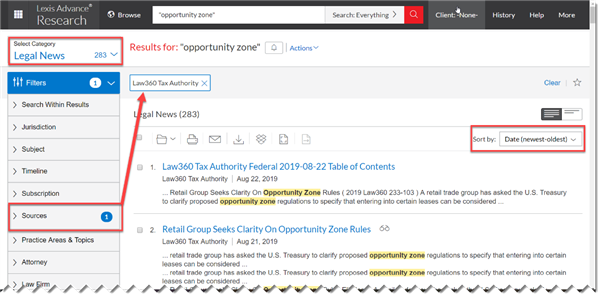

Search our leading collection of News and Legal News on Lexis Advance to access a wealth of perspectives on tax-related emerging issues like this one, including exclusive in-depth, specialized tax news coverage from Law360® Tax Authority.

Simply enter your search terms on the streamlined Lexis Advance home page to search across all content, to obtain comprehensive results from our vast collection of news from more than 26,000 sources.

Law360 Tax Authority

To zero in on critical tax developments with trusted tax news and commentary, expert analysis and related source materials, select the category of Legal News from the pull-down menu to the left of your result set. Then, use the Sources filter to select Law360 Tax Authority, a daily tax news source designed specifically for the deeper information needs of tax professionals. You can see the latest news by sorting your results set using the Sort by: pull-down menu to select Date (newest-oldest).

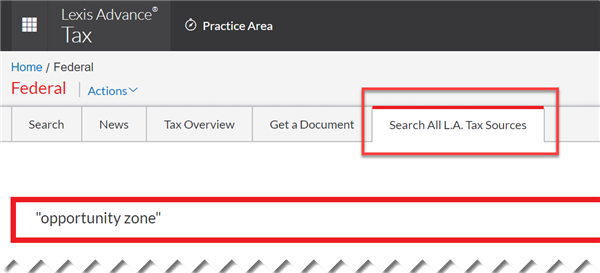

If you have access to Lexis Advance® Tax, you can find this content just as easily. Select the Search All L.A. Tax Sources tab and enter your search, then filter your results, as above.

On Lexis Advance Tax, clicking on News in the federal, state and local or U.S. international areas also provides enhanced access to search or browse the most recent two weeks of news from Law360 Tax Authority, by jurisdiction.

Rely on timely news with expert commentary and analysis

Covering federal, state and local and international tax law, Law360 Tax Authority includes insights and in-depth analysis from leading tax practitioners, law professors and other tax experts, as well as a staff of more than 30 seasoned tax journalists, to guide you through emerging issues with confidence.

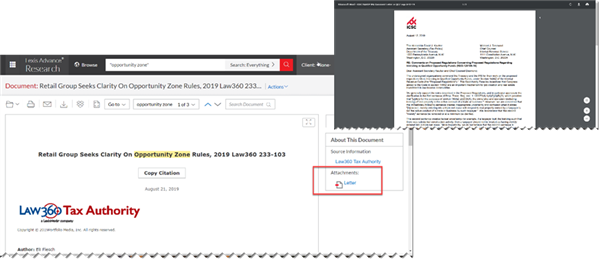

Access key source materials

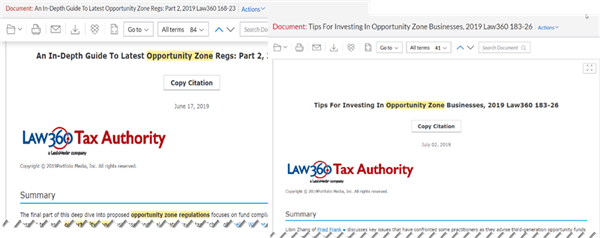

Did you know, within Law360 Tax Authority you’ll not only find critical updates and commentary on new tax developments, but also important source documents related to them?

For example, you can access “just-released” proposed and final regulations, which typically appear in Law360 Tax Authority even before they are officially published by the government in the Federal Register or Code of Federal Regulations (CFR), as well as significant public comment letters, and a variety of other essential federal, state and international tax source materials.

Look for links to these on the right margin of related news stories and commentaries. Simply click on the link to display a PDF of the document in its original format—like this public comment letter on the proposed Opportunity Zone regs.

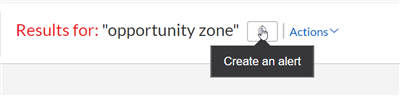

To ensure you remain up to date on continuing developments relating to Opportunity Zones—including Treasury’s much-awaited final regulations when they release—click the alarm bell icon above your results list. Set an alert on your search to deliver updated results to you by email.

Your LexisNexis® consultant can also assist you in setting alerts to deliver a daily tax newsletter that summarizes all Law360 Tax Authority news stories each day or other customized alerts on its contents to keep you informed.

Gain competitive knowledge and stay abreast of client-related news

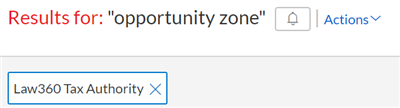

On Lexis Advance, you can stay current with both the legal and business aspects of Opportunity Zone investments that are critical to clients. For more Legal News and News, simply remove your Law360 Tax Authority filter at the top of your results page by clicking the “x” beside it.

Drawing on the vast Lexis Advance collection, in your full result set, view the categories of Legal News and News. You will find extensive coverage of newsworthy Opportunity Zone investments, developments, deals and trends, such as these materials from The American Lawyer®, New York Law Journal®, Real Estate Forum®, GlobeSt.com and other exclusive ALM® publications. In News, you can also tap an unparalleled array of leading business news sources and industry-specific periodicals, many found only on Lexis Advance, to derive key market, client and competitive insights.

Leverage practical guidance resources for more on this and other TCJA-related topics

Lexis Practice Advisor® provides an extensive collection of practical guidance with task-oriented practice notes, annotated forms, clauses, checklists and other materials designed to help practitioners work more efficiently and productively. Across the full span of Lexis Practice Advisor practice areas, you’ll find hundreds of timesaving materials that address tax-specific issues, among them many impacts of the TCJA, in the pertinent context of specific transactions and workflows.

As just one example, Lexis Practice Advisor Tax provides an invaluable practice note on the first set of Opportunity Zone proposed regulations to help focus attention on some of their key issues, as well as several other similar notes that bring clarity to other selected TJCA-related proposed and final regs. (To access further materials on the TCJA, in a streamlined pathfinder, consult the TCJA Resource Kit.)

LexisNexis, Lexis Advance, Lexis Practice Advisor and the Knowledge Burst logo are registered trademarks of RELX Inc. Law360 is a registered trademark of Portfolio Media, Inc. ALM, The American Lawyer, New York Law Journal, Real Estate Forum and GlobeSt.com are registered trademarks of ALM Media Properties, LLC.