![item image]()

12 Apr 2020

Author : InfoPro Community Manager

$core_v2_ui.GetViewHtml($post.File.FileUrl, "%{ AdjustToContainer = 'true' }")

The end of Libor: Where do we go from here?

In July of 2017, the United Kingdom’s Financial Conduct Authority announced that LIBOR (London Interbank Offered Rate) will be phased out in 2021, as regulators look to replace it with a more reliable alternative. LIBOR is a benchmark rate that is calculated from reported interest rates that select banks pay to borrow from each other on an unsecured basis. As the transition away from LIBOR toward a new, alternative benchmark rate is well underway, there are several steps lenders and finance counsel should take now to amend existing transaction documentation and to manage new transactions.

In this quickly evolving and complex legal landscape, it is important to stay up to date and knowledgeable about Libor to help ensure a successful transition to its recommended alternative, the Secured Overnight Financing Rate (SOFR).

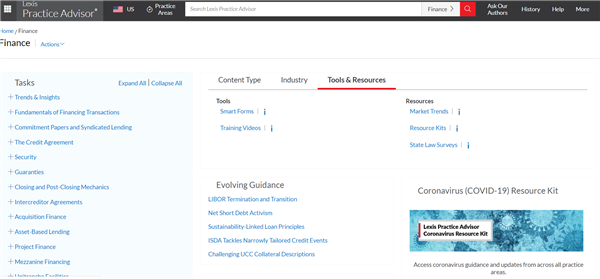

Expansive, practical content: Lexis Practice Advisor® Finance

Unique, substantive practice notes

The Lexis Practice Advisor service has several expansive, practical practice notes covering LIBOR and more general aspects of finance practice, including provisions that contemplate an inability to assess LIBOR and why these clauses are not ideal for an outright cessation of LIBOR. Specific titles include:

Market Trends and Client Alert Digests

Lexis Practice Advisor also includes Client Alert Digest content regarding LIBOR that explains a legal development, providing the background, impact and initial guidance in summary format. In addition, LIBOR-specific Market Trends pieces cover trends in the public markets. These practice notes feature notable transactions, provide insight to changes in the market and summarize recent developments in a particular practice area. Market Trends also include links to underlying transaction documents, as well as related content exclusive to the Lexis Practice Advisor service.

Annotated forms and clauses

Lexis Practice Advisor forms include drafting notes for practical guidance to inform drafting decisions, and alternate and optional clauses. Specific to LIBOR, Lexis Practice Advisor includes LIBOR replacement clause language, as well as guidance to incorporate robust fallback language in new contracts referencing USD LIBOR to help facilitate a smooth transition to alternative reference rates.

- LIBOR Replacement Clause: used to adopt a substitute benchmark interest rate in a credit agreement upon the cessation of LIBOR. This clause provides options to use either the amendment approach or the hardwired approach to transition away from LIBOR

- Increased Costs Clauses (Credit Agreement): used in a credit agreement in a typical syndicated loan transaction

- Interest Rates and Fees Clauses (Credit Agreement): included in a credit agreement in a typical syndicated loan transaction. They set forth the interest rates, interest payments and fees. These clauses include practical guidance and drafting notes

- Amendments and Waivers Clauses (Credit Agreement): used in a syndicated loan transaction to provide requirements for modifying agreement terms and for obtaining agent and lender group waivers of agreement requirements

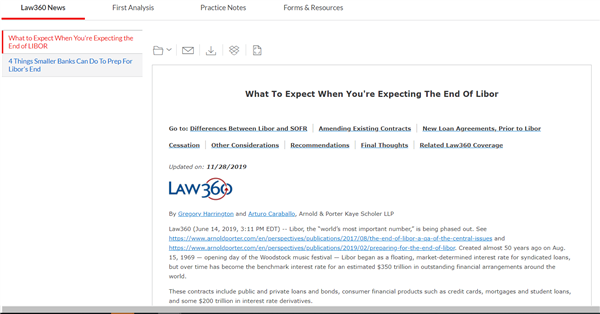

Evolving Guidance

In conjunction with the Law360® service, Evolving Guidance brings together, in one convenient location, the resources you need to get up to speed on new developments regarding LIBOR and other finance topics, and follow them as guidance emerges and new information unfolds. From current awareness and analysis to practical guidance and tools, you will find the coverage and resources you need in this easy-to-use, integrated view. Access this coverage, including unique First Analysis articles, by clicking into the topics from the Evolving Guidance pod.

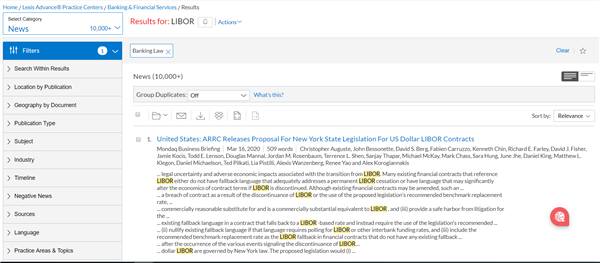

Staying current on developments regarding LIBOR

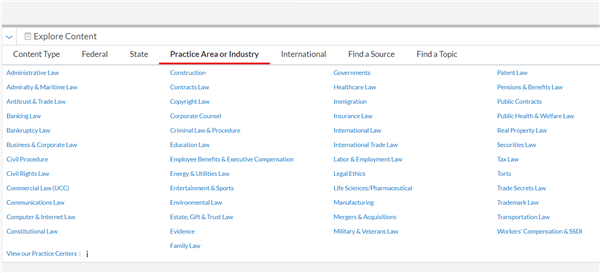

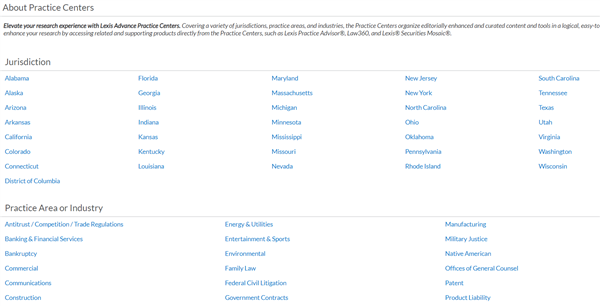

Access our leading collection of analytical sources, news and legal news on the Lexis Advance® service to find expert commentary and breaking coverage of emerging issues involving LIBOR.

The Lexis Advance service offers a unique aggregation of news and legal news, including sources like Law360, Banking Law News, LexisNexis® A.S. Pratt® Structuring and Drafting Commercial Loan Agreements, Bank Asset/Liability Management, Troubled Company Reporter, and Bank Regulatory Compliance Alert, in addition to the 26,000+ general news sources on Lexis Advance. These sources offer unique perspectives and coverage of finance issues.

Navigate to the Banking & Financial Services Practice Area and/or Lexis Practice Advisor Bankruptcy Law via Explore Content.

Navigate to a searchable collection of Banking & Financial Services sources including Cases, Statutes and Legislation, Codes and Regulations, Administrative Materials, Secondary Materials, Forms, Briefs, Pleadings and Motions, Verdicts & Settlements, Expert Witness Analysis, News and Legal News.

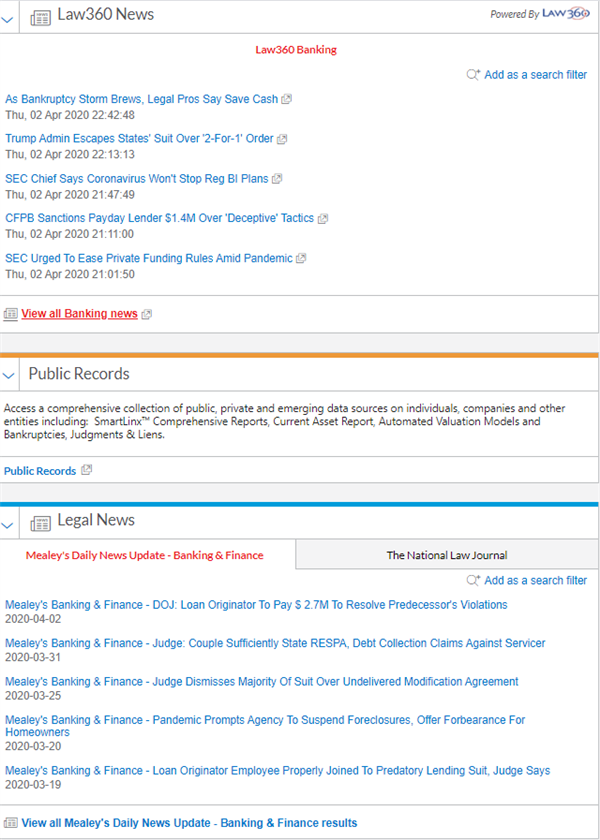

Quickly access headlines on emerging issues regarding LIBOR, including the latest litigation, regulatory and legislative coverage, compliance guidance, and risks and trends in the market with news pods linking to articles from Law360 News, Mealey’s® Daily News Updates, and The National Law Journal®.

LexisNexis, Lexis Advance, Lexis Practice Advisor, Mealey’s and the Knowledge Burst logo are registered trademarks of RELX Inc. A.S. Pratt is a registered trademark of Matthew Bender & Company, Inc. Law360 is a registered trademark of Portfolio Media, Inc. The National Law Journal is a registered trademark of ALM Media Properties, LLC. Other products or services may be trademarks or registered trademarks of their respective companies.