Ultimate Beneficial Ownership (UBO)

Gain insights into hidden connections that may expose your organisation to financial crime, bribery, or corruption risk.

What is beneficial ownership?

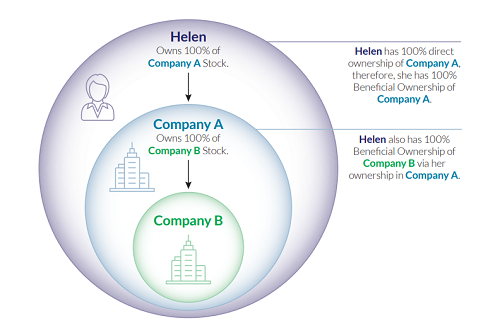

Ultimate Beneficial Ownership (UBO) is an ultimate beneficial owner or the ultimate interested party refers to the natural person who ultimately owns or controls a customer and / or the natural person on whose behalf a transaction is conducted, according to the Financial Action Task Force (FATF). This includes those who exercise ultimate legal control over a person or an arrangement.

While this is a useful definition, there is no set global standard for the application of such guidelines in different regions. In addition, the UBO can often be a moving target. Regulations are rarely static and national and supranational legislation is constantly evolving, thus, making it difficult to identify the UBO.

Who is the beneficial owner of a company?

The ultimate beneficial owner (UBO) is the natural person who ultimately owns or manages a company. This person does not have to be known directly as the owner. Such structures are not illegal, but are often used for covert criminal activities.

According to the Money Laundering Act (GwG), a beneficial owner is a person who owns more than 25% of the company's shares, controls more than 25% of the voting rights or who can similarly exercise significant control over the company.

Why is UBO Check important?

Companies of all types are required to identify beneficial owners of customers, suppliers and other third parties as part of their business partner check. You are expected to know exactly which partners you do business with. In order to prevent them from doing business with criminal parties, financial service providers, all companies operating internationally, are obliged to draw up a UBO declaration establishing the identity of a UBO or the Ultimate beneficiary, depending on the country they are doing business in.

In doing so, these companies comply with national and international laws on money laundering (AML), bribery and corruption and regulations relating to Know Your Customer (KYC) and the WWFT. This is becoming increasingly important for companies in order to avoid high fines, reputational damages and possibly imprisonment..

Want to know more about limiting risks by doing a UBO check? Download the brochure

UBO in the European Union

The 4th EU Anti-Money Laundering Directive in 2015, required a central register with information on beneficial owners (Register of Beneficial Ownership - RBO). In March 2019, the Anti-Money Laundering (AML Compliance): Beneficial Ownership of Corporate Entities Regulations 2019 directive came into force within the EU. In addition to the above, the Fifth Anti-Money Laundering Directive ( AMLD ) modifies the 'trusted and independent source' criterion for the verification of customer data by adding: if available, electronic identifiers, followed by the 6th EU Money Laundering Directive, which came into force in December 2020. This now demands that all EU member states make their registers of beneficial owners publicly accessible.

A number of new measures are also being added, including:

- extension of transparency obligations, including UBO, to all tax consultancies and funds

- possible reduction of beneficial ownership from 25% to 10% when a legal entity poses a significant risk of money laundering or tax evasion

- improved due diligence or AML compliance in handling transactions from high risk countries, and

- finding out the source of the money and the assets of the legal entity.

As of September 27, 2020, companies are obliged to register their owners or persons who have control in an Ultimate Beneficiary or UBO register. This register is also a result of European regulations.

Challenges in determining the Beneficial Owner

How do you benefit from information on beneficial owners?

Monitor UBO with Nexis Diligence

Do you want more insight into hidden stakeholders that could potentially endanger your organization? With LexisNexis risk management solutions you can identify and manage your risks even better. By conducting thorough research into the market, your customers, your suppliers and your cooperation partners, you will avoid surprises for your organization.

Our Nexis Diligence™ screening tool contains Dun & Bradstreet® UBO data on millions of companies worldwide. But also information from blacklists, PEP and sanction lists and watchlists. For example, you can find all relevant ownership information in one search to make it clear whether there are any risks.

Do you want to know more? Request a free demo via the form

Frequently Asked Questions

Answers to some popular questions

What is beneficial ownership?

What is beneficial ownership? Ultimate Beneficial Ownership (UBO) is an ultimate beneficial owner or the ultimate interested party refers to the natural person who ultimately owns or controls a customer and / or the natural person on whose behalf a transaction is conducted, according to the Financial Action Task Force (FATF). This includes those who exercise ultimate legal control over a person or an arrangement.

Why is UBO Check important?

In order to prevent them from doing business with criminal parties, financial service providers, all companies operating internationally, are obliged to draw up a UBO declaration establishing the identity of a UBO, depending on the country they are doing business in.

How to monitor UBO?

By conducting thorough research into the market, your customers, your suppliers and your cooperation partners, you can identify the UBO. Our Nexis Diligence™ screening tool contains Dun & Bradstreet® UBO data on millions of companies worldwide. But also information from blacklists, PEP and sanction lists and watchlists. For example, you can find all relevant ownership information in one search to make it clear whether there are any risks.

Get in touch

E-mail: marketingbis.asia@lexisnexis.com

Telephone number: +65 6349-0110