On 27 January 2026, LexisNexis hosted an exclusive webinar featuring Andrew Fei, a Partner at King & Wood Mallesons, who provided a clear and practical guide to the rapidly evolving world of tokenisation. With over 15 years of experience in finance law and digital assets, Andrew’s clients include the Hong Kong Monetary Authority, all three Hong Kong note-issuing banks, other global financial institutions, listed companies and major fintechs. During the webinar, Andrew took the audience on a “whirlwind tour” of the legal and regulatory landscape for tokenisation from a Hong Kong perspective.

What is Tokenisation?

Tokenisation is the process of turning real world assets (including financial products) into digital tokens on a blockchain to represent their ownership. A blockchain is a type of decentralised database that stores information across many computers, rather than relying on a single system — reducing the risk of any single point of failure. The integrity of a blockchain is maintained through a consensus mechanism, which allows the network to agree on what is valid without needing a central authority.

To hold or transfer tokens, investors use a digital wallet — software or a device that securely stores digital assets and lets users send, receive and manage them.

How to tokenise?

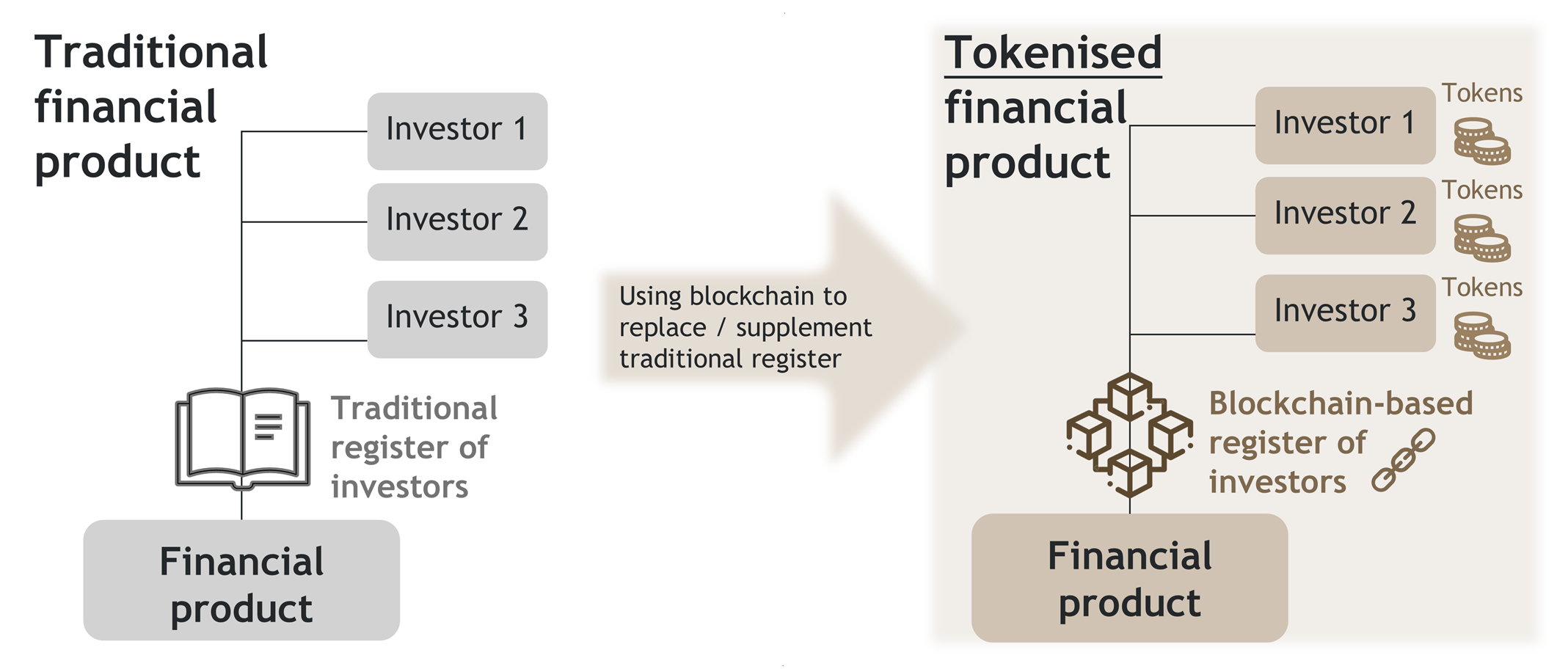

Today, most tokenised products are digital versions of traditional financial products such as bonds, shares, investment funds, deposits and loans. Andrew therefore explained how traditional financial products are tokenised.

Typically, financial products have a traditional register of investors — a centralised database (often just an Excel spreadsheet or proprietary ledger) where the issuer or its agent records and updates who the investors are, how many units they hold, and their account information for paying interest, dividends, principal and other entitlements.

Tokenisation essentially involves replacing or supplementing this traditional register of investors with a blockchain based register. The blockchain becomes a decentralised, tamper resistant record of ownership, making transfers and record keeping more efficient and transparent. Tokens are issued so that the token holder’s name or identifying information appears on the blockchain based register and is recognised as the lawful owner of the financial product.

Tokenisation of financial products can be implemented through two primary models:

- Digital Twin Model: The traditional register of investors remains the authoritative “golden source,” while the blockchain-based register mirrors it. If inconsistencies arise, the off chain register prevails.

- Digital Native Model: The blockchain-based register replaces the traditional register of investors entirely. Because this model raises cybersecurity and operational considerations, additional safeguards — often using smart contract mechanisms — are added to protect investors and comply with legal requirements.

Importantly, tokenisation does not change the underlying financial product — it simply upgrades the technology used to store and transfer ownership records.

What are the benefits of tokenisation?

Tokenisation offers a range of benefits:

- Operational efficiency: Faster and simpler transfers, settlement and record keeping through decentralised infrastructure and smart contract automation.

- Security and resilience: A decentralised database reduces single point of failure risk and enhances tamper resistance.

- Transparency: Real time, immutable ownership records improve auditability and reduce reconciliation work.

- Programmability: Smart contracts can automate payments, calculations, lifecycle events and other processes.

- Fractionalisation: Assets can be divided into smaller digital units, enabling broader investor access.

- 24/7 transferability: Tokens can move at any time, enabling near instant settlement when used with tokenised money, such as central bank digital currencies (CBDCs), tokenised deposits and regulated stablecoins.

Key takeaways for Hong Kong lawyers

Hong Kong regulators adopt a clear and consistent approach to tokenisation:

- Tokenisation generally does not change the legal or regulatory classification of an asset. Tokenised bonds, shares and investment fund interests are still treated as “securities” under Hong Kong law.

- Key regulatory principle: “same activity, same risk, same regulation.” Tokenised securities remain subject to the Securities and Futures Ordinance (SFO). Tokenised deposits and loans remain subject to the Banking Ordinance and other relevant laws.

- New technology introduces new risks. While tokenisation may not alter an asset’s regulatory classification, financial institutions must identify, manage and disclose blockchain specific risks — including technology, cybersecurity, ownership, settlement, custody, interoperability and business continuity risks.

Some tokenised real world assets (e.g., commodities or carbon credits) may fall under Hong Kong’s existing and future virtual asset regulatory framework, triggering requirements for intermediaries that engage in exchange, dealing, advisory, investment management or custody activities involving virtual assets.

Common pitfalls for lawyers

- Assuming tokenisation changes the nature of the asset. It does not — tokenisation is simply a technology wrapper around existing legal rights and obligations.

- Misunderstanding “smart contracts.” A smart contract is neither smart nor a legal contract — it is a self-executing computer code which automatically carries out agreed terms when certain conditions are met.

- Confusing digital asset terminology. Terms such as “token,” “cryptocurrency,” “virtual asset,” “stablecoin” and “CBDC” each have distinct meanings and regulatory implications.

- Thinking only physical assets can be tokenised. Intangible assets such as shares, loans, fund interests and IP rights can also be tokenised.

- Underestimating documentation needs. Transaction documents, operational rules and platform terms must be drafted carefully to reflect the new blockchain based infrastructure.

Watch the Full Webinar

To dive deeper into the "how" of tokenisation and see concrete examples of tokenised financial structures, we invite you to register to watch the full on-demand recording online:

https://go.lexisnexis.com.hk/tokenisation-what-why-how-recording

Revolutionise Your Research with Lexis+ AI

Navigating the complex legal landscape of tokenisation requires precision. Lexis+ AI is a tailor-made solution for Hong Kong practitioners that allows you to ask legal questions, summarise cases, and draft documents with ease. Unlike public AI tools, Lexis+ AI uses authoritative, Hong Kong-specific content to give you precise, cited answers and drafting suggestions in seconds.

Try it for yourself today: https://go.lexisnexis.com.hk/lexis-ai-webinar-trial