Risk & Compliance

Why Investment Banks Are Using GenAI for a Creative Edge

Innovation in investment banking has traditionally focused on speed, scale, and quantitative precision. But as genAI gains traction, a new focus is entering the equation: creativity. Creativity is emerging as a key driver of differentiation, especially when paired with data and applied through genAI tools. A Creative Shift in a Historically Analytical Industry New research from the LexisNexis Future of Work 2025:...

Regulatory Risk: Navigating Legal and Compliance Challenges

Regulatory risk encompasses the potential for financial loss, operational disruption, or reputational harm when an organization fails to meet the requirements of applicable laws, regulations, or internal policies. It can emerge from legislative change, inconsistent implementation, gaps in governance, or misinterpretation of existing rules. While often discussed in the context of fines or sanctions , its scope is broader...

Driving GenAI Adoption: How Investment Banks Can Overcome Resistance and Lead Strategic Change

For Partners in investment banking, the real opportunity in genAI lies in accelerating insight, boosting client value, and protecting margin. Generative AI is rapidly becoming a differentiator in financial services. Top-performing investment banks are starting to see how genAI doesn’t just speed up research and pitch development but also frees analysts to focus on the thinking that wins deals and deepens client relationships...

What the Kroll Report Means for Your Business and How it Manages Third Party Financial Crime Risk

This year’s Kroll Fraud and Financial Crime Report found companies are growing increasingly concerned that third parties are driving a higher risk of financial crime. We read through the report to pull out lessons for companies from this survey of 400 executives across 8 countries. By implementing these lessons–with help from LexisNexis–firms can improve their management of third party risk. “Third-party gatekeepers...

Six Things to Know About Emerging HRDD Regulations

Millions of companies around the world have been impacted by regulations which mandate them to carry out ESG and human rights due diligence (HRDD in the last few years–or they soon will be. These regulations bring new legal, financial, strategic and reputational risks for firms. However, navigating this regulatory landscape is further complicated by disparate requirements across jurisdictions and the nuanced interpretations...

Four Regulatory Enforcements Against Alleged Third Party Compliance Failures

Global companies have been fined hundreds of millions of dollars for alleged compliance breaches in the last year. Whether the allegations against them related to bribery and corruption or breaches of new human rights due diligence legislation, a recurring theme in many cases was the involvement of third parties. In the first blog in our Third-Party Risk series, we dive deeper into four of those cases and offer clear...

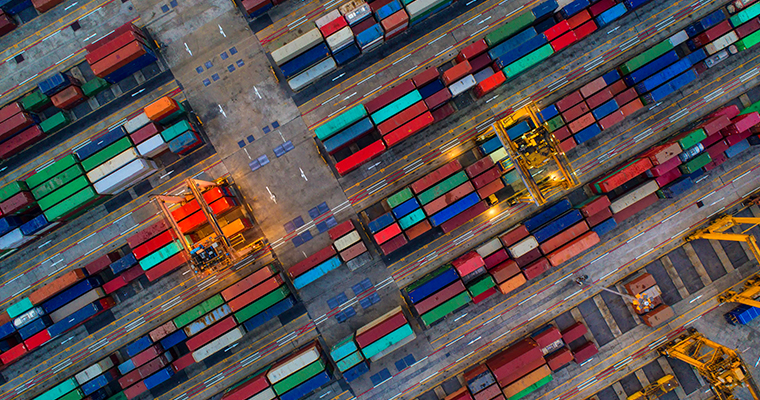

What the Ukrainian War Has Meant for Third Party Risk Management

From Stricter Sanctions to Broken Supply Chains: What the Ukrainian War has Meant for Third Party Risk Management February 2024 will mark two years since the latest conflict in Ukraine began. As well as its tragic impact on so many lives, the war has also brought new third party risks which companies need manage–or face supply chain interruptions or even enforcement action by regulators. In this blog, we look at the...

If You Haven’t Addressed These 5 Third-Party Risks, You’re Behind the Curve

Third parties help companies to deliver their products and services, but they also expose them to regulatory, financial, strategic and reputational risks. In the latest blog in our third party risk series, we look further at five key third party risks facing your company. Then, we explain how companies can mitigate them by investing in the right data and technology to support an effective compliance operation. 1. Regulatory...

Financial Crime is on the Rise. Here’s How Your Company Can Stay a Step Ahead

Financial crimes such as bribery, corruption and money laundering are becoming more common and more complex. One of the most common reasons for a company becoming implicated in alleged financial crime is its exposure to the activities of its third parties and suppliers. In this blog, we look at the trends in financial crime that your firm should be aware of. We then suggest how companies can improve their third party...

Why We’re Paying Attention to Human Rights & ESG Regulations

Over the last five years, the dominant regulatory trend in global compliance has been the spread of legislation which mandates companies to carry out Human Rights and ESG Due Diligence (HRDD) on third parties and suppliers. This has significant implications for any company operating in a jurisdiction with HRDD regulations–or whose third parties and suppliers operate there. In the latest blog in our Third Party Risk Series...

When to Call in the Media Intelligence Experts

Today’s PR specialist s shoulder many responsibilities—but there is perhaps nothing more fundamental to a successful communications strategy than ongoing media monitoring. After all, how can you accurately measure the effectiveness of your key messages or conduct competitive research if you don’t understand how your brand is being portrayed? While automated solutions are ideal for day-in, day-out media monitoring needs...

Five AML Fines and Lessons

What Companies Can Learn From 5 Recent Fines by Global Regulators for Alleged Money Laundering Alleged breaches of Anti-Money Laundering regulations are leading to increasingly large fines against companies, as we have shown over the course of this AML Risk series . In this blog, we dive deeper into five recent enforcement actions by regulators around the world to find lessons all companies can learn to improve their...

AML Fines are on the Rise. Here’s How to Avoid

Anti-money laundering fines are up by 50%. Here's how your company can avoid being next Avoiding a breach of Anti-Money Laundering ( AML ) regulations–and the fine that follows–should be a priority for any company in 2023. The financial costs of a compliance failure is increasing, with global fines against companies rising by 50% year-on-year. In the latest blog in our AML series, we look some recent global fines for...

How Companies Can Spot Money Laundering Before the Fine

Prevent and Detect: How Companies Can Spot Money Laundering Before the Fine Companies are receiving ever larger fines for allegedly breaching anti-money laundering regulations–in fact, the total fines issued globally in 2022 was 50% higher than in 2021. As well as the financial hit, compliance breaches inflict significant legal, reputational and strategic damage on companies. It is therefore critical that banks and...

Seven Ways Companies Can Effectively Respond to the Global Spread of New Anti-Money Laundering Regulations

Seven Ways Companies Can Effectively Respond to the Global Spread of New Anti-Money Laundering Regulations In the last blog in our AML series , we outlined the major developments which are driving rapid regulatory changes across the world. Today, we are going a step further by suggesting seven ways companies should respond to these emerging regulatory risks. Implementing these best practices for compliance and due diligence...

Why Understanding and Monitoring Sanction Lists is Crucial for Business Due Diligence

Sanctions are often hot topics of international news reports, especially as they relate to foreign governments and international relations. But, you may not realize that sanctions can be levied to any entity that violates regulations. Sanctions are also important to businesses, and working with those who have been sanctioned can have serious consequences. As such, monitoring and understanding sanction lists is a key...

Using Visualizations of Negative News to Monitor Your ESG Efforts

Organizations are facing more calls for Environmental, Social and Governance (ESG) accountability than possibly ever before. Investors want to know that the companies they own stock in are good stewards of the earth and responsible corporate citizens. Likewise, consumers want to know the brands they do business with share the same core principles as they do. And governments and regulatory bodies are now looking to usher...

Understanding Third Party Environmental Impacts is an Urgent Challenge--Effective Due Diligence Can Help

As environmental, social, and governance regulation is becoming a standard requirement--not only from government regulation but from shareholder representations, businesses need to think more about how they are incorporating it into their strategies. However, only 5% of the UK’s largest companies have published a ‘credible’ environmental plan that would comply with forthcoming regulations, according to a new report. This...

The US Foreign Corrupt Practices Act: What it Means for Your Business

The Federal Corruptions Policy Act was established to address and end corruption and bribery in US business dealings with foreign officials. The FCPA seeks to keep legitimate businesses from losing contracts to companies engaged in corruption and bribery. The act does not solely speak to first tier businesses—it further requires all businesses have a process of due diligence to assure corruption and bribery is not happening...

Sanctions Surveillance: 9 Crucial Steps to Help Prevent Costly Sanctions Breaches

With the ever-growing focus on ESG and increased compliance legislation across the globe, it has become even more important for business to keep up with regulation to avoid costly sanctions. Even if your business is not violating the law directly, you can be found liable for sanctions if your third-party partners are violating the law. That's why a rigorous and continuous due diligence process is so important. In...

New Wolfsberg Principles warn global banks of the risk factors that require Enhanced Due Diligence on a wide range of data

The Wolfsberg Principles are widely regarded as authoritative guidance for how financial institutions should respond to the rising risks of bribery and corruption. New guidance has recently been released for the first time in six years. We unpack its main recommendations of risk factors which should prompt banks to carry out enhanced due diligence, and explain how technology can help to improve and upgrade their compliance...

3 Reasons Working with State Owned Enterprises Demands Comprehensive Third Party Due Diligence

According to recent estimates, state-owned enterprises (SOEs) account for over 10% of the world’s GDP and more than a fifth of the world’s largest companies.The increasing presence of SOEs in the global economy has resulted in a number of high-profile corruption and bribery cases. These cases represent a profound compliance challenge for entities engaging with SOEs, requiring enhanced due diligence . Decrypting bribery...

Key Trends in Risk and Compliance in 2023

We are already more than halfway through 2023, so if your business isn’t up to date on all the newest trends and shortcuts in the realm of risk mitigation and compliance, suffice it to say you’re falling behind. This year, there is an even greater push on ESG compliance , protection from rising technology like AI and Crypto, and the general need for due diligence to avoid working with sanctioned third parties. Here...

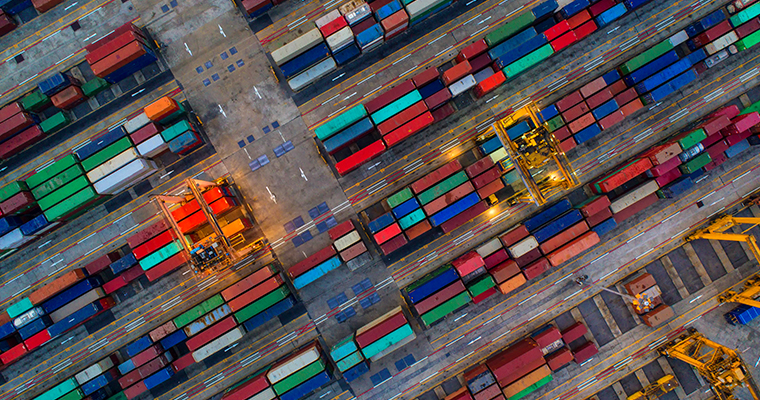

Is the Whole World Marching Toward Mandatory Supply Chain Due Diligence?

As the world has changed, so have requirements for managing business risk. Supply chains have grown more complex and less transparent. Negative news spreads like wildfire across myriad media channels. And governments—including the EU, UK and US—have upped regulatory pressures for companies to address adverse human rights and environmental impacts associated with doing business. Expanding on existing laws related to...

The ESG Risk Series: How Due Diligence Helps to Protect Companies’ Reputations Against Social Risks

Regulators increasingly require corporates and financial services firms to incorporate Environmental, Social and Governance (ESG) risks into their due diligence and reputational risk management processes. ESG also brings opportunity: asset managers and investment banks have enjoyed significant returns by moving assets into sustainable funds, while companies who are transparent about their ESG commitments have been profitable...