How to improve your media monitoring management The media landscape is always changing. New platforms and communications channels are seemingly introduced daily; trends develop at a moment’s notice and...

While environmental social governance (ESG) initiatives are increasingly becoming standard corporate practice, some organizations are still hesitant to invest the time and capital required to pursue a...

Social media statistics are one of the most underrated areas of insight when it comes to marketing and public relations. Because this medium is one of the easiest ways to interact with fan bases, it holds...

Media monitoring is the key to seeing the clearest picture of how your company is functioning. Yet, it can feel like a monumental task to manage all the available information, while also making sure your...

If you want your business to succeed, a marketing strategy is essential. Although the value of your everyday content marketing plays a role in building trust and loyalty, creating a targeted marketing...

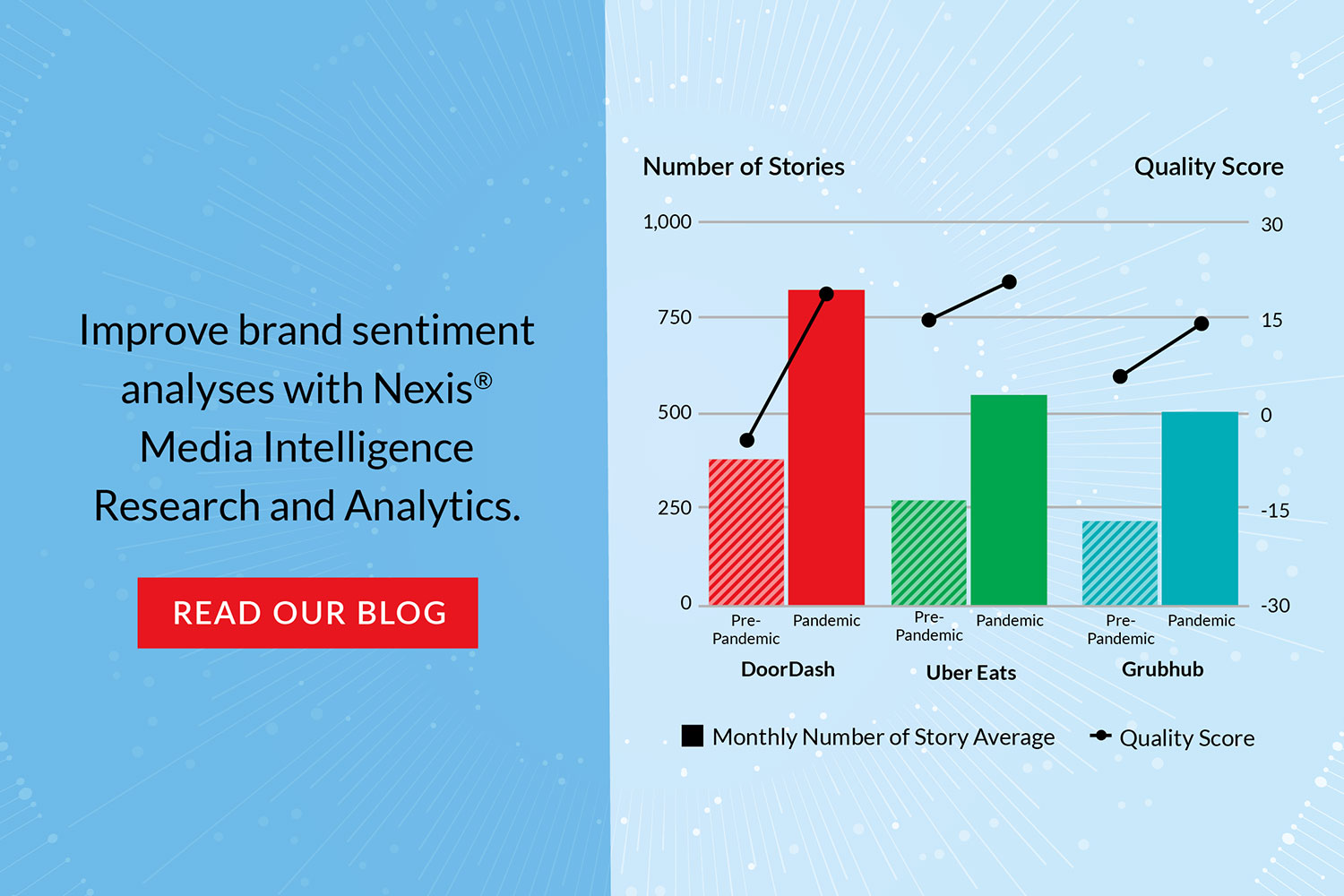

Understanding whether media coverage of your brands or company trends positive, negative, or somewhere in between is crucial for developing effective strategies to protect your reputation and achieve your organizational goals and objectives. But unlike Goldilocks, you don’t have the time to try—and try again—to discover the right insights. Previously, we shared that our Nexis® Media Intelligence, Research & Analytics (MIRA) team applied human analysis to Nexis Newsdesk® search results and the underlying metadata related to media coverage of food delivery services. The goal? To better understand how a major world event—the pandemic—impacted media attention.

Media mentions of food delivery services heats up

The MIRA team began analysis of traditional media coverage—print, broadcast, and web-based content—by examining stories about DoorDash, Grubhub, and Uber Eats from September 2019 through April 2021. This provided a baseline of coverage pre-pandemic for comparison with discussion during the pandemic. In addition to utilizing the media monitoring and built-in analytics enabled with Nexis Newsdesk, the team applied its own expert analysis, dissecting a random sample of 1,000 stories from more than 23,000 traditional media stories in US media outlets.

As we noted in our earlier blog about this research, the big three food delivery apps saw a persistent boost in coverage after the pandemic took hold. But that’s not the only aspect that the MIRA team explored in its media evaluation.

Media measurement against specific metrics yields a better understanding of sentiment

Each story was reviewed against a set of eight key metrics designed to measure and assess how DoorDash, Grubhub, and Uber Eats were covered by the US media, including:

- Prominence of Mention – Whether the delivery app was mentioned in the headline, and, if not, whether the app was mentioned prominently or only in passing.

- Dominance of Discussion – Whether the delivery app was the sole focus, shared focus, or not the focus of the story.

- Story Focus – Whether the story focused on corporate news, financial news, management/personnel news, product/service news, regulatory/legislative news, or other news.

What they discovered was informative.

For example, as you can see from the graph above, product or service news dominated traditional media coverage of the delivery apps. This coverage was positive overall and often discussed restaurants available through the apps, the apps’ impact on restaurants’ economic viability during the extended pause in in-person dining, and new product launches or services, such as Grubhub’s partnership with the Girl Scouts.

The graph also shows that the worst coverage for the delivery apps appeared in regulatory or legislative news, with this negative attention discussing the treatment of gig workers and proposed legislation to force gig work companies to hire employees or to limit the fees that delivery apps can charge restaurants.

Media analysis also allows the team to clearly visualize the leading positive and negative messages affecting how the brands were portrayed. As you can see in the chart below, the worst coverage highlighted the harm that the apps cause for restaurants and the high fees the apps charge restaurants. Interestingly, the second most prominent message fell on the positive side of spectrum and focused on the value that food delivery services brought to restaurants by helping them stay in business during prolonged lockdowns.

Want to know more? See how media monitoring and analysis delivers the insights you crave.

Learn what else influenced sentiment by downloading the latest infographic on our analysis.