Essential Parliamentary monitoring, direct from Canberra's press gallery by LexisNexis® Capital Monitor™

Restrain for here and now, with balanced investments for a prosperous future

by LexisNexis Head of Current Awareness Pacific, Antoaneta Dimitrova

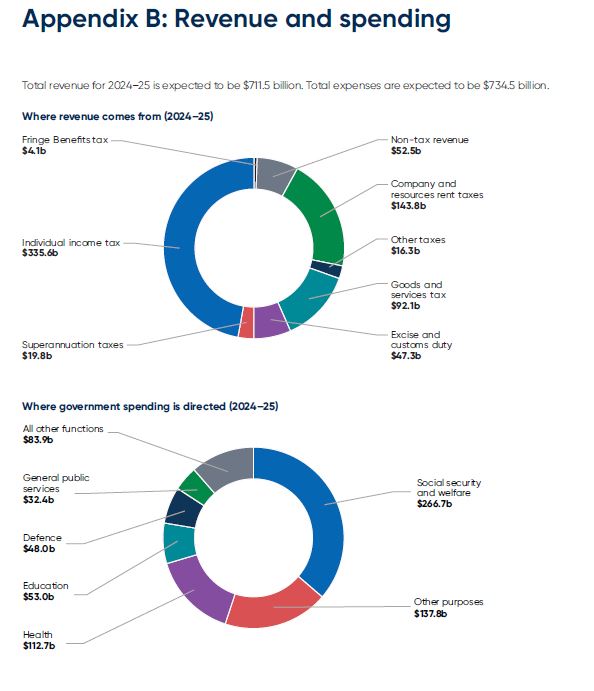

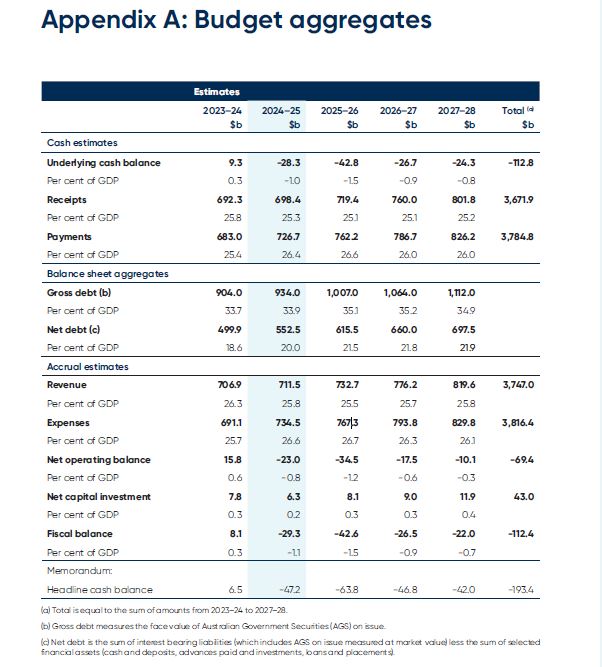

This is the pitch the Albanese Government will stick with throughout May following the release of its 2024-25 Federal Budget, the third since winning the election two years ago. Not only is Treasurer Jim Chalmers able to claim responsible fiscal management under Labor over the last two years but also the capacity to deliver consecutive surpluses year on year. The underlying cash balance for this financial year is forecast to be $9.3 billion (0.3 per cent of GDP), following the $22.1 billion surplus the year before (measuring an improvement of $10.5 billion since MYEFO estimates in December).

All despite delicate global and domestic economic conditions. Treasury expects global growth to remain flat over the forward estimates at just above 3% due to high inflation, macroeconomic policies, geopolitical tensions, and challenges in large economies such as China. In Australia, a blend of moderating but persistently high inflation, rising interest rates and the impact of global uncertainty have contributed to slower-than-expected growth in the last 12 months, with real GDP projected to grow 1¾ per cent total in 2023-24. Gross debt is projected to peak at 35.2 per cent of GDP in 2026-27, 9.7 percentage points lower than was forecast in the 2022 Pre-Election Economic and Fiscal Outlook. It would however remain subdued over the period immediately ahead, projected to grow by 2 per cent in 2024-25 and 2¼ per cent in 2025-26, and 2½ per cent in 2026-27.

Faster than-expected inflation moderation has beaten projections at MYEFO, according to Treasury, with headline inflation likely to return to the target band by the end of 2024 (calendar year), and earlier than previously expected. A robust labour market and historically low unemployment rate plus record high employment participation and growth rates have measured higher than most other major advanced economies, yet the market is expected to soften over 2024-25. The unemployment rate is likely to see a marginal rise (just over 4 per cent) but remain below pre-pandemic levels.

Overall, since May 2022 when the Labor Government took over from the Coalition, highlights associated with responsible fiscal management according to the Treasurer include:

- Improved cumulative underlying cash balance by an estimated $215 billion, reducing cumulative deficits by around two-thirds over the six years to 2027-28,

- Returned 82 per cent of tax upgrades to the Budget over the forward estimates, including 96 per cent in this Budget (2023-24),

- Found $77.4 billion in savings and re-prioritisations,

- Limited real spending to an estimated average of 1.4 per cent until 2027-28, compared to the 30-year average of 3.2 per cent and the 4.1 per cent average,

- Lowered the projected peak in gross debt as a share of GDP from 44.9 per cent of GDP to 35.2 per cent of GDP (lowering the peak by almost 10 percentage points of GDP),

- Side-stepped approx. $80 billion in interest payments over the medium-term due to the improvements to the Budget position.

Inflation remains the primary challenge of the Budget in the near-term, but the Government has managed to pull off cost-of-living respite and fund-measured investments to prop up some medium to long-term economic growth without adding to the inflationary pressures. Various measures such as tax cuts, cheaper medicines, the backdated student debt waiver, rent assistance, energy bill relief, new housing and infrastructure spending, the Future Made in Australia and Care Economy packages, and more are going to help the Budget achieve this over the forward estimates and beyond.

The Government expects that higher wages, projected moderation in inflation, ongoing employment growth and the Government's cost-of-living tax cuts would support real household disposable incomes and a recovery in household consumption.

Next financial year however the Treasurer expects a deficit of $28.3 billion (1 per cent of GDP), driven mainly by the Government's cost-of-living relief measures and addressing 'unavoidable spending including terminating health funding and frontline services'. Treasury expects that the underlying cash balance over the six years to 2027-28 however would be stronger in every year compared to PEFO and improve by a cumulative $214.7 billion.

Please click below for detailed budget updates generated from Capital Monitor

LexisNexis Capital Monitor brings you all the Federal Budget updates straight from the source in the Australian Parliament House and the Budget Media Lock Up. In-depth coverage and raw source material will be delivered to you within minutes of embargo lifting, so you can easily stay informed of developments as they happen. Learn more here.