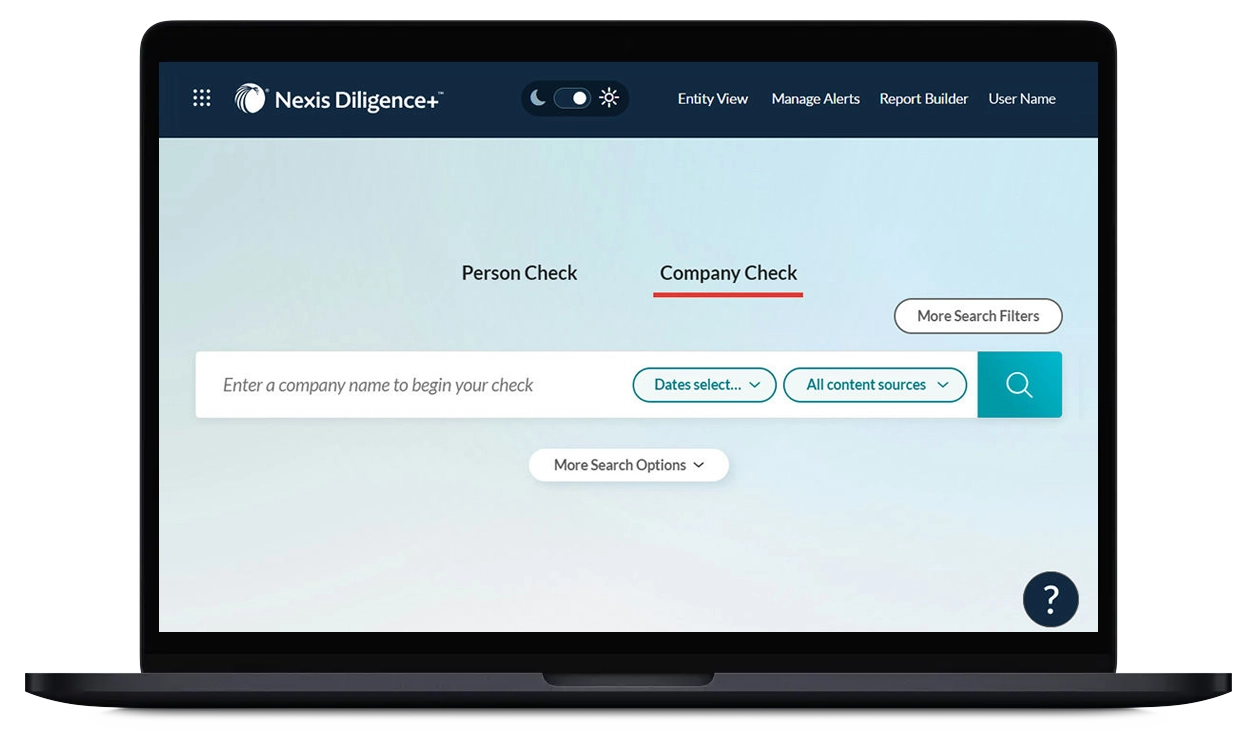

Overseeing a merger and acquisition or screening a potential business partner? Nexis Diligence+ serves as the all-in-one due diligence software for assessing any potential risk from the people and third-party entities interacting with your business.

item 136,000+ sourcesNegative news from international, national & regional publications

Access a comprehensive archive of licensed negative news sources to help proactively identify reputational and regulatory risks. With real-time updates and multilingual query support (English + 14 languages), Nexis Diligence+ empowers faster, better-informed due diligence decisions.

item 22.5 million profilesSanctions, watchlists & PEPs

Monitor global sanctions and watchlists from over 1,000 sources, alongside 2.5 million profiles of politically exposed persons (PEPs), their family members, and close associates. Integrate seamlessly into your due diligence workflows for thorough risk screening.

Item 3270+ million recordsCompany and people data

Access data from over 400 databases covering 270+ million public and private companies and individuals worldwide. Nexis Diligence+ enables comprehensive background checks while aligning with your internal compliance processes.

item 4Billions U.S. public records

Leverage billions of public records from more than 10,000 sources to uncover connections between people, businesses, locations, and assets—supporting a complete and accurate risk profile.

Reputational risk

Reputational risk  Regulatory risk

Regulatory risk  Financial risk

Financial risk Third party risk

Third party risk  Adverse media

Adverse media  ESG

ESG