Automate & accelerate due diligence

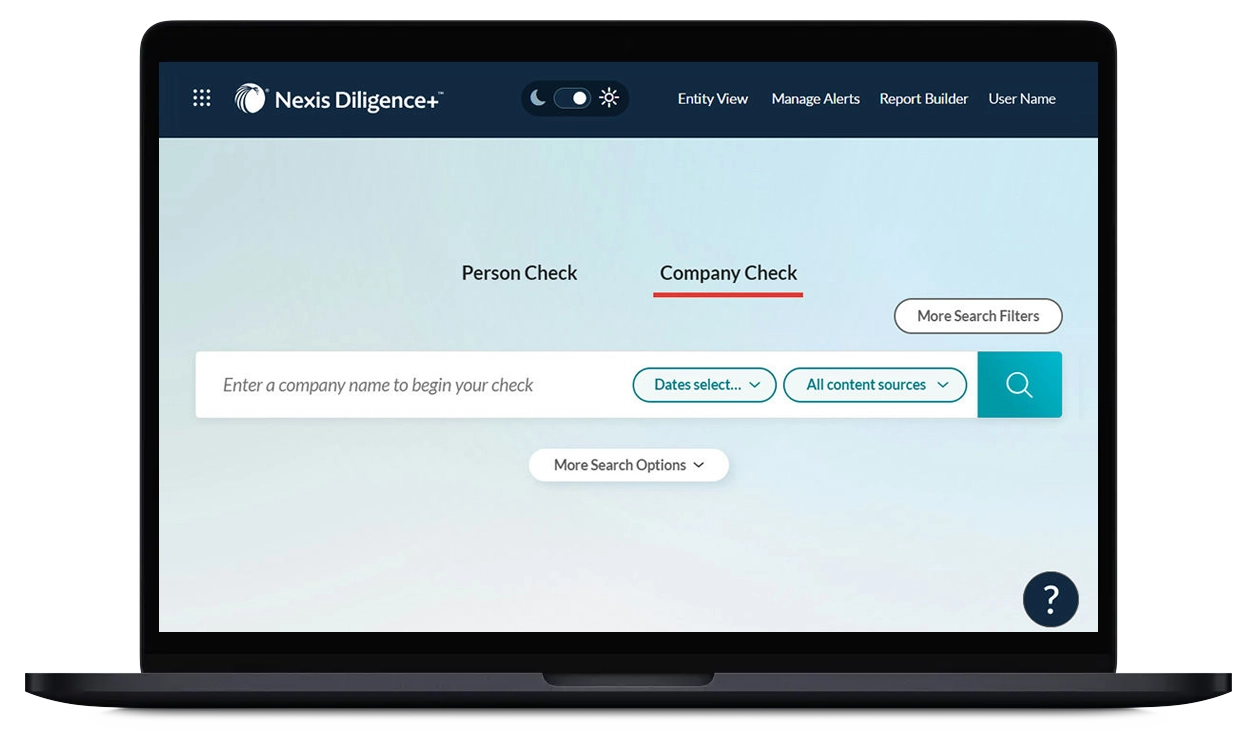

Quickly vet and monitor third parties, map complex relationships, and perform high-volume checks from a single, intuitive dashboard.

Nexis Diligence+ is an enhanced due diligence solution that helps you investigate people and companies with greater clarity and confidence. It brings together trusted content, compliance tools, and risk assessment features to support smarter decisions and meet regulatory requirements.

Nexis Diligence+ gives you access to a broad set of global data sources essential for enhanced due diligence. From sanctions and watchlists to ESG ratings, legal records, financial data, and international news, the platform helps you uncover hidden risks and validate third-party relationships with confidence.

“I don’t want to imagine a world where I don’t have access to Nexis Diligence+”

- Thomas, Veraxis Research Group

Nexis Diligence+ combines sophisticated technology with an unmatched collection of data. So, you can conduct due diligence at scale to identify threats and avoid chaos.

Quickly vet and monitor third parties, map complex relationships, and perform high-volume checks from a single, intuitive dashboard.

Upload and assess an unlimited number of entities in bulk, saving time and effort across large-scale due diligence projects.

Set alerts to stay informed of potential risks as they emerge, enabling timely reviews and proactive risk mitigation.

Gain access to unmatched global content curated specifically for enhanced due diligence, including news, watchlists, company data, and legal sources.

Create customized, auditable reports in just a few clicks with the built-in automated report builder—ideal for internal review or regulatory requirements.

Streamline your due diligence workflow with a scalable research platform that supports bulk uploads, centralized results, and efficient reporting.

Nexis Diligence+ incorporates powerful risk assessment tools to help you identify potential threats and make informed decisions with confidence. Whether you're conducting due diligence on individuals or organizations, Diligence+ supports a consistent and efficient approach to risk management across key areas.

Learn more about the categories of enterprise risk we cover, or contact us to request a demo tailored to your needs.

Overseeing a merger and acquisition or screening a potential business partner? Nexis Diligence+ serves as the all-in-one due diligence software for assessing any potential risk from the people and third-party entities interacting with your business.

Access a comprehensive archive of licensed negative news sources to help proactively identify reputational and regulatory risks. With real-time updates and multilingual query support (English + 14 languages), Nexis Diligence+ empowers faster, better-informed due diligence decisions.

Monitor global sanctions and watchlists from over 1,000 sources, alongside 2.5 million profiles of politically exposed persons (PEPs), their family members, and close associates. Integrate seamlessly into your due diligence workflows for thorough risk screening.

Access data from over 400 databases covering 270+ million public and private companies and individuals worldwide. Nexis Diligence+ enables comprehensive background checks while aligning with your internal compliance processes.

Leverage billions of public records from more than 10,000 sources to uncover connections between people, businesses, locations, and assets—supporting a complete and accurate risk profile.

Having one resource through which to find all relevant information has completely changed the team’s ability to assess new business relationships.

Employing Nexis Diligence provides a comfort level and assurance that we are engaging those clients that are appropriate for our firm and who meet the high standards we set for client acceptance, our work and ourselves.

Nexis Diligence enables you to develop a comprehensive due-diligence report which taps into the powerful global news archive.

The primary use cases for Nexis Diligence+ focus on helping organizations assess and mitigate risks when dealing with third parties. Nexis Diligence+ provides a global content collection and comprehensive, 360-degree view of people and companies that sets a higher standard for thoroughly assessing risk.

Risk Mitigation

Nexis Diligence+ offers several benefits over Nexis Diligence, including increased efficiency through the ability to upload multiple entities via an Excel template, which is five times faster than ad hoc searches. Other benefits include:

Learn more about Nexis Diligence+, a comprehensive due diligence solution that sets a higher standard for thoroughly assessing risk at scale. Complete the form below or call 1-888-46-NEXIS to connect with our team today.

LexisNexis, a division of RELX Inc., may contact you in your professional capacity with information about our other products, services, and events that we believe may be of interest. You can manage your communication preferences via our Preference Center. You can learn more about how we handle your personal data and your rights by reviewing our Privacy Policy.