What is ESG?

ESG stands for the three sustainability-related responsibilities of a company : environmental, Social and good corporate governance. As per ESG, companies are expected to look for the right balance between financial & economic results, transparency, social interests and the environment.

ESG and responsible investing

Investing in ESG is about influencing positive changes in society by being better in all three aspects. Taking ESG factors into account in investment decisions not only benefits the environment and the society, but can also provide competitive advantages for companies and investors by reducing financial, reputation, regulatory and strategic compliance risks.

The three critical criteria for ESG investments:

- Environmental : How do a company's actions affect the environment? This includes questions about the sustainability of the supply chain and the reduction of their environmental footprint.

- Social: How can a company increase its social impact, both inside and outside its community? Inclusion, gender equality and diversity are all factors to consider.

- Governance : How are issues related to executive pay, leadership diversity, and internal hierarchies addressed by a company?

New EU legislation for sustainable finance

The Sustainable Finance Disclosure Regulation (SFDR) has been enforced since March 10, 2021. It is a European regulation that was introduced to improve transparency in the market for sustainable investment products, prevent greenwashing and increasing transparency regarding sustainability claims from financial market participants.

The SFDR establishes an obligation for financial market participants and financial advisers to disclose: the consideration of adverse effects on sustainability in investment policies, due diligence on those securities and, where appropriate, to provide arguments not to disclose this information. From the end of 2021, the SDFR distinguishes three investment fund classifications: 'sustainability', 'ESG products' and 'unsustainability', depending on the extent to which ESG factors have been taken into account when building a fund.

Upcoming ESG Regulations

Although these regulations are primarily aimed at European organisations, companies from outside the EU that do business with these entities or have activities in the EU can also be bound by them.

- Corporate Sustainability Reporting Directive (CSRD)

According to the Non-Financial Reporting Directive (NDRD) law, since 2017 listed companies, banks and insurers are obliged to report non-financial information. However, this report has several shortcomings. For these reasons, the EU is updating the Corporate Sustainability Reporting Directive (CSRD).

The CSRD is expected to be adopted by the European Parliament and the European Council before mid-2022 and will be in force in 2023.

- Mandatory Human Rights, Environmental and Good Governance Due Diligence

The new Dutch legislation obliges companies to investigate whether their goods or services have been produced using child labor and to devise a plan to prevent child labor in their supply chains if they find it. There are significant administrative fines and criminal penalties for non-compliance. The law also imposes a notification obligation. The law was passed by the Senate in May 2019 and is not expected to enter into force until mid-2022, to give companies a period to examine their supply chains.

Why are ESG scores important?

Investors are increasingly looking at ESG factors as part of their investment analysis, recognizing the risk of tangible losses from unethical business practices and the long-term performance benefits of transparency and trust.

But how exactly is an organization's ESG score determined? An external evaluator uses a scoring methodology and calculates the score based on a wide range of ESG factors, such as emissions and environmental initiatives, human rights, shareholders and board members.

Many companies use ESG tools to better assess how well they are performing on a number of ESG issues, and to better understand the ESG performance of current and future partners.

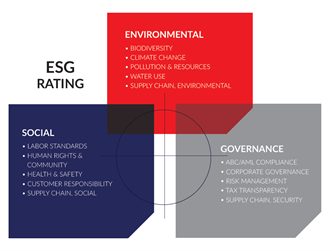

An ESG score is based on the following:

What are the risks of investing in ESG?

The recent risk warning from the Securities and Exchange Commission (SEC) highlights five key challenges to investing in ESG:

- Weak monitoring of ESG-related investments. Significant shortcomings have been identified in the policies and procedures governing the implementation and monitoring of ESG investments. Consultants often did not have access to adequate systems for tracking and updating potential negative news screening of clients.

- Unsubstantiated and misleading claims about ESG investments: Marketing materials describing unsubstantiated risk and other metrics related to ESG investments come in many forms.

- Inadequate controls on ESG-related practices: A widespread lack of compliance with global ESG frameworks despite conflicting claims and failure to update marketing materials in ESG-focused areas are two of the most common examples.

- Failure in Compliance Programs to Address Relevant ESG Issues: The SEC witnessed numerous instances where companies substantially involved in ESG investments were unable to demonstrate a sound and robust compliance and decision-making process.

- Limited knowledge of ESG : Finally, a widespread lack of knowledge was noted. Relevant employees often lack the required knowledge and understanding of ESG and related issues.

Improving Your ESG Scores with LexisNexis

LexisNexis can help you improve your ESG scores by:

- Meeting ESG requirements with Nexis Diligence

Nexis Diligence+ collects, among other things, news, company information, financial data and PEP and Sanctions lists in one place so that you can efficiently screen individuals and companies and create due diligence reports.

- Fill the ESG information gap with Big Data

Big Data can help by supplementing your existing ESG information with comprehensive coverage of ESG factors. With Nexis® Data as a Service (DaaS), you can integrate data such as PEP and sanction lists, national and international news and business information into your organization's own systems. This can give you deeper and more accurate insights so you can better understand how certain moves and decisions hurt or increase your ESG score.

- Media monitoring on ESG topics

With Nexis Newsdesk you can monitor print and online media on ESG related topics. With this media monitoring and analysis tool you stay informed of news and messages about your organization and so you can monitor your reputation.

Using our proprietary LexisNexis® SmartIndexing Technology™. ESG-related content is a good example of this. SmartIndexing searches content based on hundreds of ESG-related terms, including rating factors. In addition, the ESG Power Topic merges 175 terms, eliminating the need to build a complex query to filter the results for ESG-focused content.

Get in touch

E-Mail: information@lexisnexis.com

Telephone number: +91 99100 69136